Russians Ready for Oil Cuts to Stop Price Rout

-

Collapse in demand from coronavirus has forced Moscow’s hand

-

U.S. participation essential to secure Saudi-Russian deal

Photographer: Andrey Rudakov/Bloomberg

Russia’s oil industry is ready to agree to cuts in production together with Saudi Arabia and other major producers in a desperate bid to halt the slide in prices, according to five people familiar with the efforts.

While the Kremlin hasn’t confirmed a willingness to take part in reducing crude output by 10 million barrels, as announced by U.S. President Donald Trump Thursday in a Tweet that drove Brent oil prices up as much as 47%, Russian producers are ready for coordinated action, said the people, who spoke on condition of anonymity because the matter isn’t yet public.

President Vladimir Putin will meet oil executives and officials to discuss the situation on the world energy markets later on Friday, the Kremlin said.

The Russian reversal reflects alarm at the sudden collapse in demand sparked by the coronavirus pandemic, which threatens a worldwide recession this year. Moscow pulled out of a supply-limit agreement with the Organization of Petroleum Exporting Countries over demands for deeper cuts in output. That prompted Saudi Arabia to flood the market with oil, driving prices to an almost two-decade low amid a glut in supply because of a sharp fall-off in consumption.

Russia and Saudi Arabia could reach a deal to restrict output at an April 6 meeting of OPEC and other oil-producing nations aimed at increasing prices to $30, according to Andrey Kortunov, director of the Kremlin-founded Russian International Affairs Council. “Thirty dollars would be a lot better than twenty,” he said. “No one here expected oil prices to plunge so deeply.”

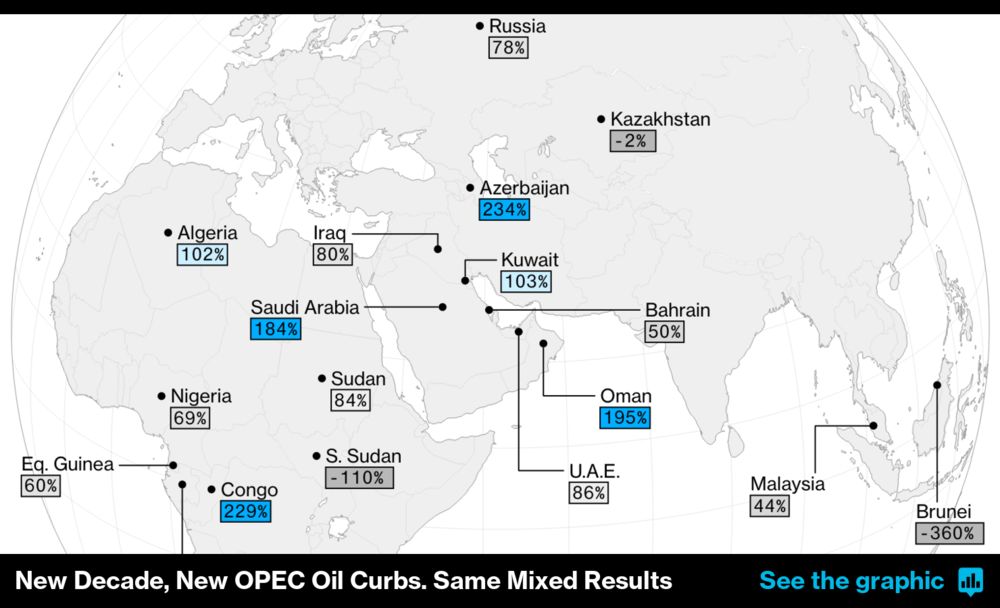

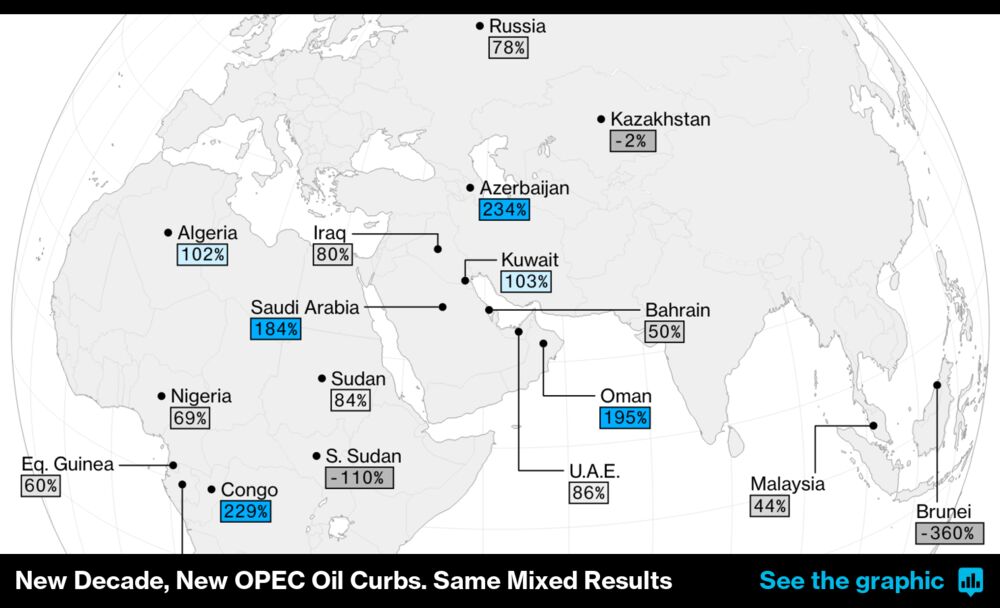

Cooperation Barrels

Russia adjusted its oil production within OPEC+ deals in past 3 years

Source: Bloomberg calculations based on data from Energy Ministry’s CDU-TEK unit

At the same time, it’s important that the U.S., the world’s largest oil producer, should participate, Kortunov said. Even if formally the Trump administration can’t commit to private companies scaling back output, it should facilitate that, said Kortunov. The rock-bottom prices have devastated U.S. oil producers, making swathes of the industry uneconomic. Trump is meeting industry officials Friday.

Russia may agree to a three-way arrangement with Saudi Arabia and the U.S., said four people at Russian oil producers. For Putin, the likelihood of all sides making compromises should reduce the risk of appearing weak by agreeing to reduce oil production.

New Members

The Energy Ministry didn’t immediately respond to a request for comment. The Kremlin referred questions to the Energy Ministry.

The OPEC+ coalition wants oil producers outside the existing group to attend next week’s meeting, a delegate said, asking not to be named talking about confidential discussions. If global producers are willing to participate, a cut of 10 million barrels a day is realistic, the delegate said.

Saudi Arabia, which was producing around 9.7 million barrels a day before the collapse of the OPEC+ agreement on March 6, had vowed to pump over 12 million barrels a day in April, giving it the ability to instantly cut almost three million barrels.

Russia averaged of 11.294 million barrels of crude oil and condensate in March. While officials insist that Russian crude remains competitive even at such low oil prices, the plunging demand risks sapping the ability to keep pumping at the same levels.

Russia isn’t likely to cut as much as promised, according to Dmitry Perevalov, an oil trader who’s the former vice-president of producer Slavneft.

“Maybe we will cut some oil output but no will be able to check up on it,” Perevalov said. “The price will go up and that’s the main thing for everyone.”

Difficult Times

The efforts that reductions would require are unprecedented and may have negative long-term effects for the oil industry, according to Dmitry Marinchenko, senior director at Fitch Rating.

“Under earlier deals with OPEC, Russia has always reduced the output gradually, yet this time around, the cut needs to be made right away,” he said. Producers would probably need to shut down some wells, while reopening wells can be nearly impossible given Russia’s geological conditions, or prohibitively expensive.

Economically, the impact of coronavirus is already wreaking such havoc that any oil deal will at best mitigate the damage. Russia is rewriting its budget to prepare for oil prices at $20 a barrel, according to people familiar with the discussions. Russia will ramp up borrowing by 1 trillion-1.5 trillion rubles ($13 billion–$19 billion) this year as a result, they said.

“If the forecasts of a 15 million- to 20 million-barrel reduction in demand turn out to be right, then no production cut will help raise oil prices,” said Kirill Tremasov, head of research at Loko-Invest in Moscow and a former Economy Ministry official. “The Russian government is doing the right thing, preparing for difficult times and a low oil prices. There are no other options.”

— With assistance by Evgenia Pismennaya, and Dina Khrennikova

- Previous Turkey’s mobility sharply decreases as COVID-19 measures yield results

- Next COVID-19: Turkey limits lemon exports as demand soars