Abu Dhabi Sovereign-Wealth Fund Gets Entangled in Sprawling Global Scandal

Investigation into the missing billions from Malaysia’s 1MDB focus on ex-officials of the emirate’s IPIC investment arm

02.12.2016 ABU DHABI—A futuristic 35-story tower where doors swoosh open with the wave of a hand houses a little-known firm long used by this emirate to deploy its oil riches around the world.

When Barclays PLC needed to raise capital in 2008, the Abu Dhabi sovereign-wealth fund, known as IPIC, invested more than $5 billion in the U.K. bank. Through a subsidiary, IPIC acquired holdings in German auto maker Daimler AG and Swiss commodities powerhouse GlencorePLC. It helped finance the ultraluxury New York skyscraper One57, nicknamed the Billionaire Building.

Driving IPIC was Khadem Al Qubaisi, a nightclub aficionado with slicked-back hair, a taste for the good life and close ties to princes who rule the emirate.

In June, Abu Dhabi’s crown prince abruptly ordered an end to the 32-year-old sovereign-wealth fund’s existence as a stand-alone firm, saying it would be merged with another state entity.

Mr. Al Qubaisi? He now sits in an Abu Dhabi jail, fired and under investigation for money-laundering, corruption and other possible offenses, according to people familiar with his situation.

Among the deals Mr. Qubaisi engineered at IPIC was one with 1Malaysia Development Bhd., or 1MDB, the embattled Malaysian state fund from which billions of dollars are missing, at least $800 million of which some investigators have said flowed into personal accounts of Malaysian Prime Minister Najib Razak.

Investigators trying to trace the money missing from 1MDB believe Mr. Qubaisi played a central role in diverting some of it, using his control of the Abu Dhabi sovereign-wealth fund to conduct money laundering and embezzlement, according to people familiar with probes that are under way in several countries.

Far from just a Malaysian affair, the 1MDB scandal is unfolding as potentially one of the largest international financial swindles ever. A look at Mr. Al Qubaisi’s dealings with 1MDB through the Abu Dhabi fund helps illuminate the scandal’s global reach, from Singapore and Switzerland to the Middle East, Hollywood and Las Vegas. This account is based on interviews with people familiar with the various investigations or with the activities of Mr. Al Qubaisi and IPIC, as well as on documents reviewed by The Wall Street Journal.

Abu Dhabi has said little about Mr. Al Qubaisi’s situation. “We are committed to bringing him to justice,” a member of the United Arab Emirates’ ruling Al Nahyan family said in a rare interview. Mr. Al Qubaisi hasn’t been charged.

Mr. Najib, who set up 1MDB seven years ago to spur local development, has denied wrongdoing. Malaysia’s attorney general cleared the prime minister early this year, saying money that flowed into his accounts in 2013 was a legal donation from Saudi Arabian royalty and most was later returned.

The U.S. Justice Department agrees most of the money left Mr. Najib’s accounts but says it instead moved back into the shell company from which it had arrived, leaving its ultimate destination unclear. The department has said most of the hundreds of millions sent to the prime minister’s accounts originated with 1MDB. The Malaysian fund declined to comment.

The Justice Department’s Kleptocracy Asset Recovery Initiative went to court in July to seek forfeiture of more than $1 billion of mostly U.S. assets the department says were acquired with money stolen from the Malaysian fund. It was the kleptocracy initiative’s largest-ever asset-seizure case.

Abu Dhabi’s IPIC—International Petroleum Investment Co.—dates to 1984, when United Arab Emirates founder Sheik Zayed Al Nahyan set it up to plow oil profits into the global petroleum industry. One of his sons, Sheik Mansour bin Zayed Al Nahyan, later became chairman.

Mr. Al Qubaisi, who hails from a prominent Abu Dhabi family, became managing director of IPIC in 2007, where he oversaw its expansion and built its flashy headquarters tower in Abu Dhabi, the U.A.E. capital.

Mr. Al Qubaisi, now 45 years old, traveled the city with several Egyptian assistants who opened doors for him and tended to his needs. He bought a personal stake in an Italian Formula One racing team and had IPIC subsidiaries sponsor it.

IPIC began investing beyond oil, such as in the transaction with Barclays, which was lucrative for both IPIC and Sheik Mansour, who was granted warrants. As a vehicle for doing large deals, IPIC acquired a local energy investment company called Aabar Investments PJS.

Mr. Al Qubaisi, part of Sheik Mansour’s inner circle, wielded broad authority. He held power of attorney at IPIC and Aabar, enabling him to sign contracts. He managed the sheik’s personal investment company, one unit of which invested in Las Vegas nightclubs. Aabar provided hundreds of millions of dollars in loans to that unit.

Out of view of IPIC’s directors, Abu Dhabi investigators believe, Mr. Al Qubaisi embarked on increasingly audacious schemes to enrich himself, according to people familiar with the matter and to documents reviewed by the Journal. On some deals, the people said, Mr. Al Qubaisi or an associate asked counterparties or intermediaries for side payments.

In a lawsuit filed against IPIC over fees, a consulting company alleged that Mr. Al Qubaisi asked for a kickback relating to an IPIC attempt to acquire hotel company Four Seasons Group in 2009. Pierre Maroun, a co-founder of the consulting firm, said in an interview that Mr. Al Qubaisi asked him during a Riyadh-Abu Dhabi flight for a $300 million kickback. In the fee lawsuit, IPIC’s lawyers denied the allegations. No deal for the hotel company was done.

Another executive said he had a meeting with Mr. Al Qubaisi at a mansion in the south of France, where, according to the executive, Mr. Al Qubaisi conducted business in a swimsuit while scantily clad women paced the rooms.

The deal that linked the Abu Dhabi fund with 1MDB began after Malaysia’s Mr. Najib visited Abu Dhabi in 2009. Malaysian media said he announced the emirate would invest $1 billion in Malaysia’s real-estate, hospitality and energy businesses via the 1MDB state fund.

Abu Dhabi handed the energy part of this plan to IPIC. Instead of contributing money, however, IPIC supplied a guarantee on $3.5 billion of 1MDB bonds, making them easier to sell.

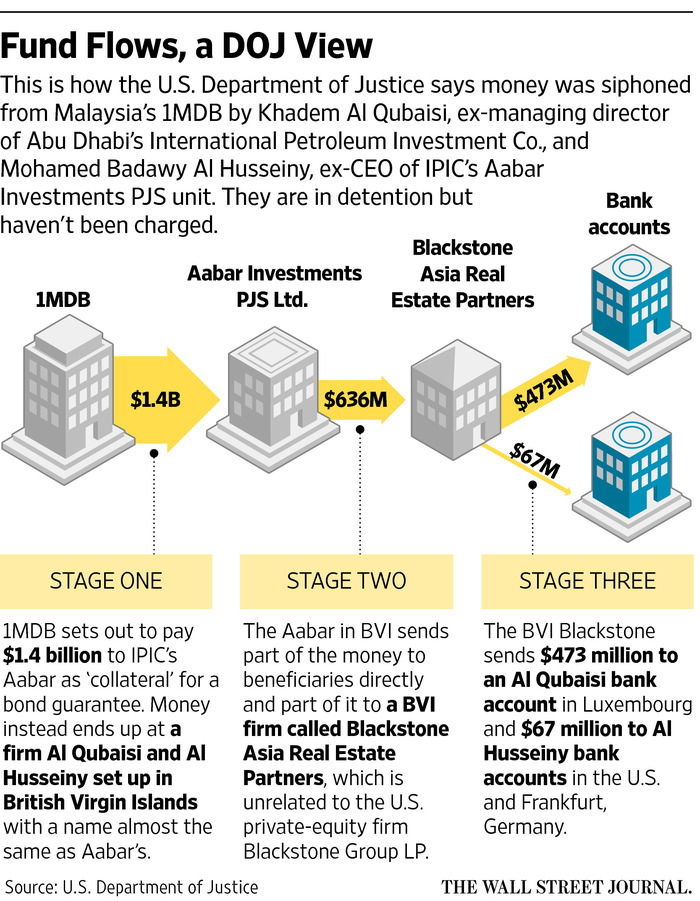

In return, 1MDB agreed to pay $1.4 billion of what was called “collateral” to IPIC’s Aabar unit. Mr. Al Qubaisi signed the deal without board approval, people familiar with it said.

The $1.4 billion of 1MDB money never reached Aabar, the Justice Department said, but instead was paid to a firm with a name nearly identical to Aabar’s that Mr. Al Qubaisi and Aabar’s CEO, an American named Mohamed Badawy Al Husseiny, had set up in the British Virgin Islands.

From that offshore firm, the Justice Department alleged in its July lawsuits, the diverted 1MDB cash was distributed to intermediaries, which sent it on to still other intermediaries, until hundreds of millions of dollars reached Mr. Najib, his stepson and others.

One of the others cited by the Justice Department was Jho Low, a Najib confidant who had helped to set up 1MDB. U.S. prosecutors have described Mr. Low as in the thick of the alleged fraud, helping orchestrate schemes to siphon away money. He is a subject of criminal investigations in the U.S. and Singapore, according to people familiar with them. Mr. Low has denied any wrongdoing.

The Najib stepson is Riza Aziz, one of the producers of the 2013 hit movie “The Wolf of Wall Street,” made with money the Justice Department has said was misappropriated from 1MDB. Mr. Aziz and his production company have denied wrongdoing, saying they had no knowledge that any money received had originated with 1MDB.

The Justice Department said in its July asset-seizure lawsuits that $473 million originating with 1MDB was transferred to a Luxembourg account owned by Mr. Al Qubaisi. The civil suits, filed in California federal court, said Mr. Al Qubaisi subsequently used some of the money to buy a $51 million New York penthouse and two Los Angeles mansions worth a combined $46 million.

The suits also said about $67 million of 1MDB money was transferred to two accounts owned by Mr. Al Husseiny, who was the Aabar CEO.

In asset-seizure lawsuits, parties who believe they legitimately own the assets can contest the Justice Department’s claims, a process that is now under way with the pending July suits. The suits are filed against the property itself and don’t include any individuals as defendants.

Like Mr. Al Qubaisi, Mr. Al Husseiny was forced out of IPIC and has come under investigation in Abu Dhabi for money laundering and other possible offenses, said people familiar with the investigation. He, too, is held in jail, they said. Mr. Husseiny hasn’t been charged.

Besides the $1.4 billion of bond-guarantee collateral, an additional nearly $1 billion of 1MDB money also vanished into the British Virgin Islands firm with a name very like Aabar’s, according to documents reviewed by the Journal and to people familiar with the investigations.

This was money 1MDB sought to pay to IPIC’s Aabar unit to cancel some options on energy assets. Investigators are still tracking this nearly $1 billion.

At one point, investigators believe, Messrs. Al Qubaisi and Al Husseiny had put more than $8.8 billion of IPIC’s money potentially at risk through guarantees of 1MDB-related deals and loans, according to people familiar with the probes. IPIC has said some of the guarantees weren’t authorized. It is locked in a commercial dispute with 1MDB.

In other lines of inquiry, as described by people familiar with the 1MDB probes:

•Mr. Al Qubaisi’s management of Sheik Mansour’s investment business has led to a focus on Las Vegas. A restaurant company controlled by the sheik’s business spent $207 million building the Omnia nightclub at Caesars Palace and a club called Hakkasan Las Vegas, where British singer Rita Ora sang “Happy Birthday” to Mr. Al Qubaisi in 2013, according to someone who was there.

U.S. investigators are looking into whether any funds diverted from 1MDB were indirectly provided to the restaurant company, Hakkasan Ltd., said people familiar with the probe. There is no suggestion of wrongdoing by Hakkasan, which said its capital had no connection with 1MDB. The firm has said the Justice Department confirmed Hakkasan is “not the subject or target of their 1MDB investigation.”

•Investigators are examining whether 1MDB money ultimately transferred to an Al Qubaisi-controlled account was used to make payments on Sheik Mansour’s 482-foot yacht, the Topaz, whose eight floors include a swimming pool, cinema and two helicopter pads. Sheik Mansour didn’t respond to requests for comment.

•IPIC owns Swiss-based Falcon Private Bank, and investigators are looking at whether Messrs. Al Qubaisi and Al Husseiny used it to facilitate some transactions at issue. Swiss and Singaporean regulators recently fined Falcon for money-laundering breaches, including an alleged transfer of 1MDB money into Mr. Najib’s accounts. A Swiss regulator said the dealings were driven by “two representatives of the bank owners,” which a person familiar with the case said meant Messrs. Al Qubaisi and Al Husseiny. Falcon declined to comment.

By 2015, Mr. Qubaisi’s wealth included bank accounts across the world, homes in France, private jets and about $31 million worth of automobiles in Switzerland, including a Bugatti Veyron and a Pagani Huayra. In his office, he kept fine cigars in a box emblazoned with his initials, KAQ. At least some of the assets now are frozen, including tens of millions of dollars in a Luxembourg bank account.

Around March of 2015, during a dispute between Mr. Al Qubaisi and a former employee, photos were published online showing him cavorting in a St. Tropez nightclub with a seminude woman sitting in a giant drinks glass. It was behavior of which the U.A.E. ruling family took a dim view.

During this period, fraud suspicions relating to missing 1MDB money were emerging. In April 2015, Abu Dhabi’s emir removed Mr. Al Qubaisi from IPIC without explanation.

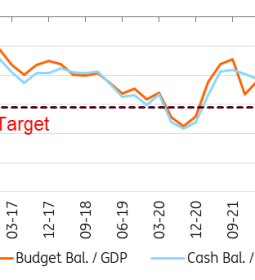

In June of this year, IPIC reported a net loss, attributed to low oil prices, and said it was taking a $3.5 billion provision related to bond guarantees given to 1MDB. Abu Dhabi authorities said they had decided to merge IPIC into another state fund, Mubadala Development Co. They described the move as part of a strategic vision to streamline emirate-owned companies and funds.

People with knowledge of the discussions said Mr. Al Qubaisi’s ouster, caused in part by the 1MDB scandal, was a critical factor in accelerating the plans. Two months later, he and Mr. Al Husseiny were arrested.

—Simon Clark contributed to this article.

Write to Bradley Hope at bradley.hope@wsj.com and Nicolas Parasie at nicolas.parasie@wsj.com

- Previous Three traders associations withdraw suit against Maria and four others

- Next Singapore to Ban Former Goldman Banker in Connection With 1MDB Scandal