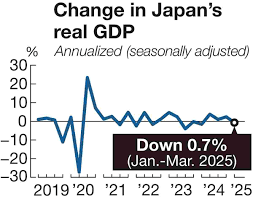

Japan GDP in Q3 lost 2,8%: What to blame: a US tariff hike impact or crisis in relations in China!?

Gross domestic product (GDP) shrank an annualized 2.3% rather than 1.8%, the Cabinet Office said on Monday, the quickest rate since the third quarter of 2023. Economists on average had estimated 2%, saying the contraction was likely to be reversed in the next quarter and that the revised figures would have minimal impact on the Bank of Japan’s (BOJ) next interest rate decision.

The contraction translates to a 0.6% on-quarter fall, compared with analysts’ estimate of 0.5% and an initial reading of 0.4% released last month.

Exports dropped 1.2% compared to the previous quarter, unchanged from the preliminary figure, while private residential investment fell 8.2%, slightly less than the 9.4% fall seen in the earlier data. Imports slipped 0.4% during the quarter, the data showed.

Trump implemented higher tariffs on imports from many countries earlier this year.

In September, the U.S. lowered the tariff surcharge on nearly all Japanese imports to 15% from an earlier plan to impose 27.5% on autos, a serious blow to the economy, and 25% on most other goods.

Japan has promised to invest $550 billion in the United States, in an accommodating move announced during the tariff negotiations.

The tariffs have strained bilateral ties between Japan and the U.S., its most important alliance partner.

Japan now has its first female prime minister, Sanae Takaichi, who remains popular, partly because of her assertive, nationalist-leaning comments. She is also fostering hopes for an economic revival, although prospects remain unclear.

The BOJ is likely to raise its policy rate at its Dec. 18-19 meeting and the government is set to tolerate the decision, sources told Reuters.

“The results wouldn’t significantly change the overall assessment of the economy,” said economist Uichiro Nozaki at Nomura Securities. “Expectations for a rate hike in December have risen considerably, and that’s largely because of strong prospects for next year’s spring wage talks. The path (to normalize monetary policy) is unlikely to change.”

New regulations weigh on housing investment

Private consumption, which accounts for more than half of the economy, inched up 0.2% in July-September rather than 0.1% after reflecting data on dining out, the revised figures showed.

Analysts say the drop in private residential investment was mainly due to revisions of Japan’s building code that caused housing starts to plunge from earlier this year.

The capital expenditure component of GDP, a barometer of private demand, fell 0.2%, after incorporating the most up-to-data. The initial estimate was a 1% rise and economists had estimated an uptick of 0.4%.

External demand – or exports minus imports – knocked 0.2 percentage points off growth, unchanged from the preliminary reading. Domestic demand shaved off 0.4 percentage points, compared with 0.2 percentage points in the initial data release.

Looking ahead, economists said the world’s fourth-largest economy is likely to return to growth in the next quarter, anchored by a slow recovery in private consumption, though U.S. tariffs are likely to pressure exports.

“As for capital investment, although demand for digital and labour-saving investment is strong, deteriorating corporate earnings will intensify downward pressure, so the pace of increase will likely remain moderate,” said senior economist Masato Koike at Sompo Institute Plus.

- Previous IndiGo falters in a major way and exposes big risks in Indian aviation

- Next Malaysian PM Anwar calls for restraint between Thai and Cambodian militaries