In Oil Face-Off, Saudis, Shale Both Claim Victory

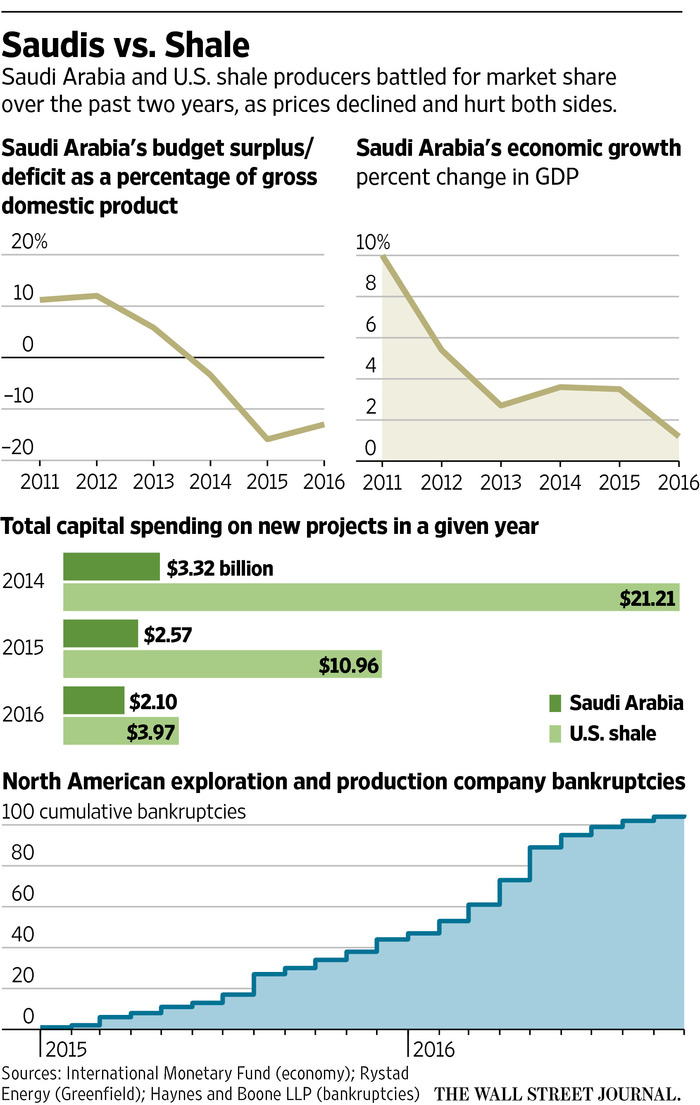

A two-year battle for global oil supremacy that pit Saudi Arabia, the de facto leader of OPEC, against upstart U.S. shale producers left them both badly wounded but with each side claiming victory.

The Organization of the Petroleum Exporting Countries deal last month to cut oil production has sparked a powerful rally after crude prices had fallen by half over the past two years. That slide followed OPEC’s decision in late 2014 to maintain production levels, despite a global glut.

For U.S. shale companies, it was two years of shrinking profits and mass layoffs as dozens of producers scaled back output or sought bankruptcy protection. But the survivors became much more efficient and are now eager to grab market share at their foreign competitors’ expense.

“Definitely, the U.S. is going to win the next two years because OPEC is cutting and U.S. shale is taking off,” said Scott Sheffield, chief executive of Pioneer Natural Resources Co., a U.S. producer that is already ramping up drilling in West Texas’ Permian Basin.

In Saudi Arabia, two years of lower oil prices have greatly slowed economic growth, widened a budget gap and led the government to cut fuel and other popular subsidies in moves that risked stirring public discontent.

Yet the collapse in crude prices didn’t stop OPEC from gaining global market share as shale retreated. It also helped jump-start Saudi Arabia’s plans to move away from a decadeslong dependency on oil. The kingdom raised a record $17.5 billion with its first global bond deal in October.

Now, Riyadh is betting that a period of rising prices following the production cut could boost a vast initial public offering of the state-owned Saudi Arabian Oil Co. An IPO of just 5%, as planned for 2018, could fetch over $100 billion and help fund an expansion of the Saudi economy into other sectors such as technology and mining, Saudi officials said.

Shale producers may also have a small window to take advantage of higher prices. OPEC and other major producers have pledged to cut output only for six months, and the group has a history of exceeding production quotas.

Saudi Arabia two years ago elected to counter a rise in U.S. output with a flood of its own. Ali al-Naimi, Saudi oil minister at the time, denied he was targeting shale but often said he wanted to force out of the market the “high-cost producers,” a phrase often interpreted to mean U.S. shale. Back then, many shale producers couldn’t break even unless crude prices were about $80 a barrel.

Two years of low prices pounded the U.S. oil industry. More than 100,000 energy workers have lost their jobs. The services companies that help drill and pump oil have jettisoned people and equipment.

While activity in the Permian Basin is booming, other once-bustling shale formations in south Texas and North Dakota haven’t recovered.

But U.S. oil and gas producers raised more than $50 billion through secondary offerings in the stock market during the past two years, a financial lifeline that kept many afloat despite their debt.

Many were able to raise this money by persuading investors that they could adapt faster than OPEC realized. These producers made strides in technology and drilling techniques, driving costs down to where they can get by at oil prices of just over $50 a barrel, said U.S. Energy Secretary Ernest Moniz in an interview last week.

“The cost of production next year is going to be a lot less than the cost of production last year,” Mr. Moniz said. As long as OPEC holds to its promise to cut back output, “you’ll see some of that shale oil coming back,” he said.

Saudi Arabia officials said losses in the U.S. oil industry vindicated their approach. Although the kingdom has pledged to cut output by 486,000 barrels a day, that is far less than what U.S. producers were forced to cut by low prices.

“The U.S. has cut more than anybody else,” a senior Persian Gulf official said.

Had oil prices remained between $70 and $80 a barrel, U.S. production could have increased to as much as 11 million barrels a day in the past two years, said Doug King, chief investment officer at RCMA Asset Management. Instead, U.S. output has fallen from a peak of 9.6 million barrels a day in 2015 to 8.6 million barrels a day in September.

OPEC production has risen: Its market share is now almost 42% of global supply, after it fell below 40% in 2014, according to the International Energy Agency.

“The OPEC strategy—they’ve won. They wanted market share, and they took it,” said Dan Pickering, head of the asset-management arm of Tudor, Pickering, Holt & Co.

—Ahmed Al Omran and Ryan Dezember contributed to this article.

Write to Benoit Faucon at benoit.faucon@wsj.com, Alison Sider at alison.sider@wsj.com and Georgi Kantchev at georgi.kantchev@wsj.com

- Previous China says no country can be exception to ‘one China’ principle

- Next Under Vladimir Putin, Russia Plays a Smart Round of Global Martial Arts