India’s Money Launderers Soil Modi’s ‘Spring Cleaning’ of Cash Drastic measures are being taken to dispose of wads of paper currency

NEW DELHI—Unable to spend or deposit their sackfuls of large bank notes amid India’s crackdown on hoarding cash, business owners across the country are paying employees months of salary in advance, ringing up bogus sales and even buying gold they can smuggle overseas to get rid of stashed money or conceal its source.

Such illegal workarounds are threatening to undercut Prime MinisterNarendra Modi’s move this month to cancel India’s highest-denomination rupee bills, which was meant to punish tax evaders and other criminals and bring more of the nation’s $2 trillion economy out of the shadows.

If Mr. Modi’s unprecedented social-engineering project fails to net too many of the biggest tax cheats, he risks further incurring the wrath of Indians already frustrated with the pain and economic dislocation the experiment has brought about in its first two weeks.

ENLARGE

ENLARGE“Canceling these 500- and 1,000-rupee notes has caused inconvenience to you,” the prime minister said at a recent rally. “But some people’s whole life has been ruined—that is how I have punished them. Because they looted the poor, the middle class. They looted your money to run their business. That is why I launched this fight.”

Tax officials in India have for decades played testy games of cat-and-mouse with rich individuals and businessmen who accumulate wealth off the books and store it as real estate, jewelry, financial assets and cash stuffed in wardrobes.

Only about 20 million individuals and families, or around 1.6% of the country’s population, paid any income tax in 2013. Government revenue from personal and corporate income tax is less than 6% of the size of the economy in India. In advanced nations, the average is around 12%.

Requiring Indians to exchange their big bills at banks for newly created ones—or suffer a quiet, potentially catastrophic financial loss—was Mr. Modi’s way of forcing hidden riches to the surface. There, authorities would be watching, ready to examine large cash deposits.

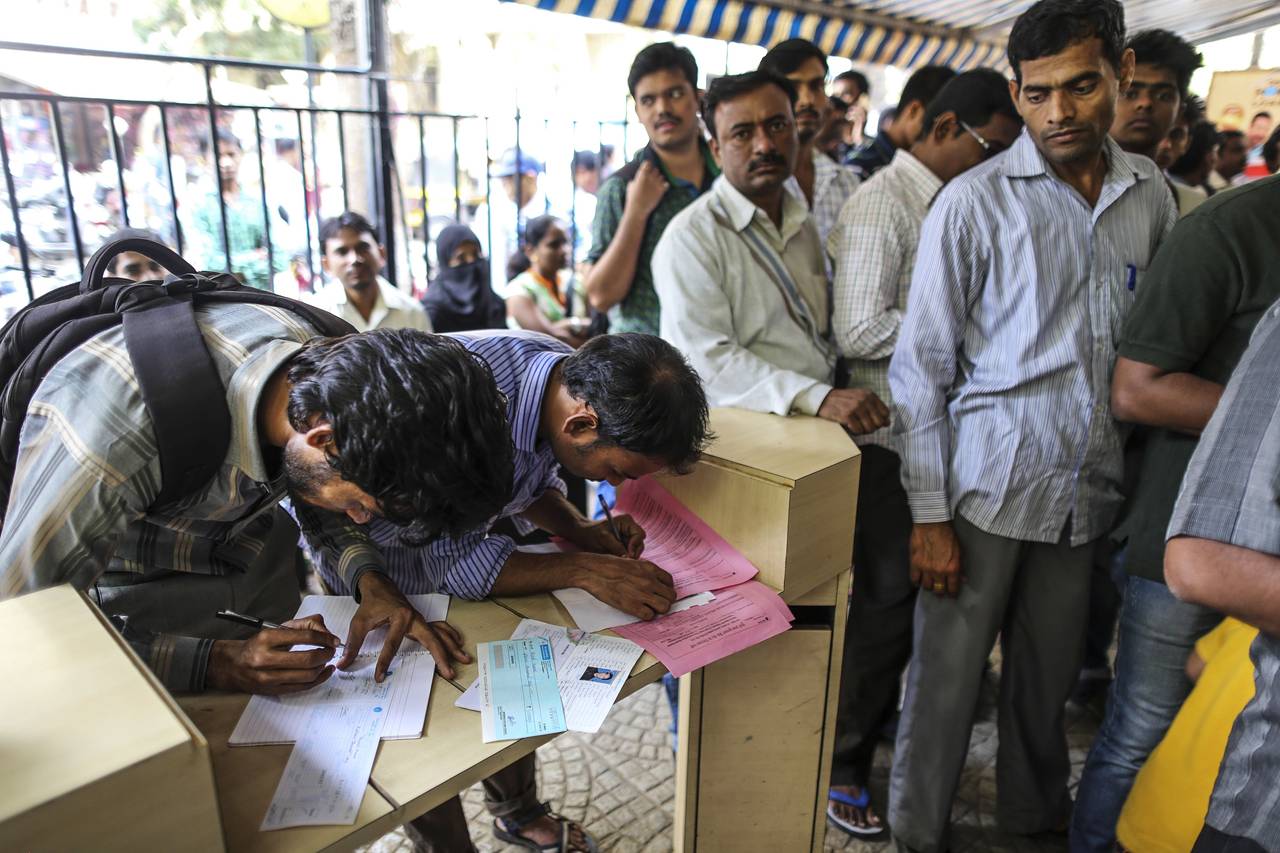

Millions of Indians have heeded the call. Since Mr. Modi’s Nov. 8 announcement more than $80 billion in old bills has been exchanged or deposited. That is around 40% of the value of all large rupee bills in circulation. The deadline for turning in canceled bills is Dec. 30.

Others are discreetly jettisoning their cash stockpiles in more-inventive ways.

In Kolkata, a longtime hub for illicit financial activity, a lively trade has sprung up for converting voided bills into new bank notes, gold or checks, each for a different price. Tax officials say some people are buying gold with old notes and smuggling it out of the country, where it can be resold for hard currency. Recently, a man was caught trying to bring 2.5 kilograms of gold, worth nearly $100,000, on a Mumbai-to-Dubai flight. Usually in India, the gold-smuggling goes in the other direction.

“We are on alert as more people try to take gold overseas,” one revenue official said.

A retailer in northeastern India said he helped account for his cash pile by writing up invoices showing nonexistent past sales. Accountants in Mumbai have advised builders to pay subcontractors with invalidated bills. The subcontractors use the cash to pay laborers, whose meager earnings make their transactions less likely to face official scrutiny.

“Any poor person right now in India is useful for tax dodgers whose money is just going to evaporate,” said Prashant Thakur, a former income-tax officer in Kolkata.

Enough rich Indians were enlisting others to redeem small batches of cash at multiple bank branches that the Ministry of Finance last week ordered banks to mark people’s fingers with indelible ink when they come in to exchange old bills.

This safeguard—which India also uses to prevent people from voting more than once during elections—hasn’t proved airtight. This week, outside a dingy auto-parts store behind a bank in New Delhi, people were using diluted battery acid to wipe the ink off their fingers. The shop’s owner wouldn’t say whether he sold them the acid.

“In India, if there are five people thinking about making a law, there are 50 people thinking about breaking that law,” said Mukesh Butani, managing partner at BMR Legal, a New Delhi-based law firm.

Disposing of bigger bankrolls requires even greater ingenuity.

One cooking-gas distributor in the northern state of Uttar Pradesh ticked off the many ways he unloaded his cache of 7 million rupees, or around $100,000. His connections at banks helped him deposit around 500,000 rupees in old bills, backdating the transactions so they appear to have gone through before the notes were canceled on Nov. 9. The priest at a local temple accepted 35,000 rupees and gave it back to him in 100-rupee notes, he said.

He also paid more than 40 of his employees—laborers, accountants, guards, drivers—months of salary and bonuses in advance. “My security guard was overjoyed,” the businessman said.

While such leaks may prevent authorities from ever nabbing many Indians who sidestep taxes, some economists say they could also be cushioning the immediate blow dealt by the currency squeeze, which has choked off cash-based commerce this month.

ENLARGE

ENLARGELaundered bills, unlike those kept under mattresses, remain in the economy for others to spend. That helps prevent the money supply from contracting too severely.

“If the ‘black economy’ was contributing 10% or 20% or 50% of GDP growth, and if you wipe that portion off the economy, it is obvious to have a negative impact,” said Nikhil Gupta, an economist at Motilal Oswal Securities in Mumbai.

Mr. Butani, the lawyer in Delhi, said India has to do more than void notes if it wants to wean itself off cash. It also has to target the underlying reasons for which businesses amass paper money, such as the need to pay officials who demand bribes.

Whatever the legal-tender status of 500- and 1,000-rupee bills, “if an inspector wants money from me, he still wants it,” said V.K. Agarwal, managing director at a small electrical-cable manufacturer in Lucknow. “He says, ‘Give me new notes—I don’t care where you get them from.’ So what do I do?”

Politics in India is another big cash business. Because the country’s electoral rules don’t require political parties to disclose the sources of small donations, companies regularly use cash to buy influence. Parties then use the cash to buy votes ahead of elections.

The currency replacement is just “a spring-cleaning exercise,” said Jagdeep Chhokar, co-founder of the New Delhi-based Association for Democratic Reforms, which advocates for greater transparency in party financing. “Unless we change our way of living, our house is not going to be clean. It is going to get dirty again every year.”

—Biman Mukherji contributed to this article.

Write to Raymond Zhong at raymond.zhong@wsj.com

- Previous Malaysian ringgit divides experts, with some seeing Trump, 1MDB risks

- Next A Presidential Scandal Transfixes South Korea

You may also like...

Recent Posts

- Clear and present threat to regional and global security: Pakistan’s overpopulation is a massive ticking bomb

- Really!? Israel fades as Türkiye rises in global geopolitics

- SCOTUS stab back Trump tariff/foreign policy: 10% a bitter sweet response from White House

- India – 13.5% now, not 25%: implications of SCOTUS tariff ruling, steps announced by Trump

- Uzbeks and Kazakhs want to double rail freight volume to 60 million tons

- No new spaces in return for 26.11.25 fire victims: Hong Kong government offers to buy apartment ownerships from fire victims

- Japan governor to cash for snitching on undocumented foreign workers

- Western Geo-Strategic Miscalculation: Brits and US Dems’ Try To Whitewash Their Sins and Fairytale War in Ukraine to Their Lost Cause

- Guitar playing is over: Ex-South Korean President Yoon gets life sentence for insurrection

- President Trump: 11 very expensive jets shot down, Shahbaz – “Trump saved 25 million lives when he stopped the war between us and India”

Random news

Views

- North Korea’s New Intermediate-Range Ballistic Missile, the Hwasong-12: First Takeaways - 988 views

- Chinese military base in Djibouti necessary to protect key trade routes linking Asia, Africa, the Middle East and Europe - 985 views

- OIC, 57-nation Islamic body calls US travel ban a ‘grave concern’ - 712 views

- Goods from China start to be shipped by train to Europe: Luxembourg-Chengdu freight train route launched - 681 views

- Kyrgyzstan actively working on start of construction of China—Kyrgyzstan—Uzbekistan railroad - 591 views

- Iran tested medium-range ballistic missile - 556 views

- Why Indians want to have white skin?! Pakistani authors thoughts. Article: The complexion of a new culture - 555 views

- China: Philippines can’t claim Benham Rise - 537 views

- Gabbard allies rush to her defense after Assad meeting - 517 views

- America’s $1.1 Trillion National Security Budget - 339 views

About us

Our Newly established Center for study of Asian Affairs has

branches in Indonesia, Malaysia and Singapore, as well as freelances in some other countries.

For inquires, please contact: newsofasia.info@yahoo.com Mr.Mohd Zarif - Secretary of the Center and administer of the web-site www.newsofasia.net