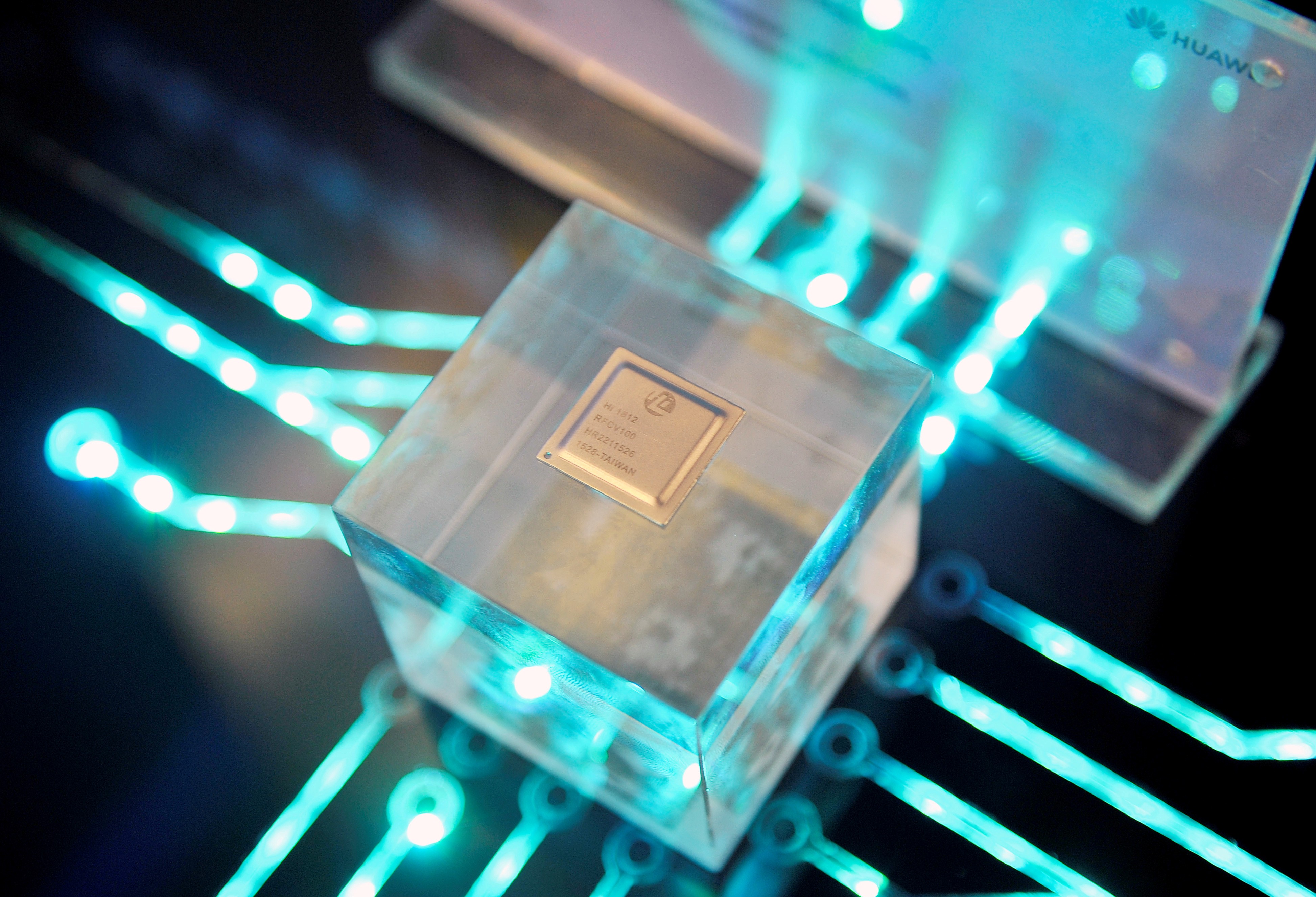

Is ‘Made in China 2025’ as big a threat as the West thinks it is? Beijing looks east to Taiwan for chips

- Mainland China has stepped up its efforts to attract skilled tech workers as its aims for self-reliance in the semiconductor industry

- More career opportunities and better pay are key factors enticing skilled engineers to make the move

Like hundreds of thousands of tech workers in Taiwan, James Chen used to believe he would spend his whole career at Hsinchu Science Park, one of the world’s most significant centres for semiconductor manufacturing and the home of more than 400 companies.

But now, entering his sixth year working for a Chinese company in the mainland province of Guangdong, Chen said he had no plans to return to the island – even though the strategic competition between Beijing and Washington across a wide range of issues, including technology, had become increasingly intense.

There have been growing concerns that the year-long trade war with the US, as well as Washington’s threat to ban American suppliers from selling sophisticated chips to Huawei, China’s telecoms equipment giant, for national security reasons, would hamper the country’s ambitious investment in chip-making facilities and talent.

On Saturday at the G20 meeting in Japan, US President Donald Trump said he would allow Huawei to buy American products. But many observers worry that the rivalry with the US has delayed Beijing’s goal of domestically sourcing 40 per cent of all chips used by industry by 2020, and 70 per cent by 2025 under the Made in China 2025 plan.

Chen, a veteran engineer from Taiwan’s top-tier chip makers who is now in charge of setting up his own team for the company, said his decision not to return to the island was not difficult.

“There is bigger room to grow and much more to anticipate on the mainland,” the 41-year-old from Hsinchu said. “In Taiwan, the market has been occupied by big companies so the platform for growth could be relatively small.”

There are no official numbers about how many Taiwanese are working at tech companies on the mainland, but a widely cited statistic suggests that about 9 per cent of the island’s population, or 2 million people – including businessmen, managers, students and their families – are living on the mainland.

“Moving west” is not a new phenomenon for Taiwan’s tech workers, but industrial observers said the trend has become more pronounced over the past few years. Beijing has stepped up efforts to attract skilled people like Chen as part of its efforts to reduce the country’s dependence on overseas firms – particularly for the semiconductors that power everything from smartphones to military satellites.

The mainland’s progress in chip production is largely a result of partnership with companies from Taiwan, one of the leading players in the industry. What makes the relationship awkward, of course, is that Taiwan is a self-ruled, democratic island but Beijing considers it a wayward province subject to eventual unification, by force if necessary.

Major integrated circuit designers and chip makers in Taiwan, such as MediaTek, VIA Technologies, Realtek and TSMC, have set up factories or joint ventures on the mainland over the past decades, and skilled engineers and management officers have been sent over.

Still, the gap in the manufacture of advanced chips remains wide across the Taiwan Strait. One example is the capability to make sophisticated chips: TSMC, Taiwan’s top chip maker, is expected to start delivering its 5-nanometre chips next year, but Semiconductor Manufacturing International Corporation, a Taiwanese-founded chip maker which is now the largest in China, has yet to start mass production of its 14nm chip.

A nanometre (nm) is one billionth of a metre and often used to measure the size of chips. Usually the tinier the chip, the less power it consumes and the greater its performance. It is widely believed that it may take at least two decades for mainland Chinese chip makers to catch up with the world leaders.

In 2017, China imported US$260 billion worth of semiconductors, more than its imports of crude oil. Chips made on the mainland accounted for less than 20 per cent of domestic demand in the same year, according to the China Semiconductor Industry Association.

“Talent is key to developing the chip industry and in China there is a shortage in almost every sector, from packaging to design,” said an industry observer from Taiwan, adding that “compared with those from South Korea or Japan, people from Taiwan are the best choice because we speak the same language, with a similar cultural background and are known for being hard-working”.

Companies on the mainland have increased their efforts to attract Taiwanese workers, particularly after 2015 when Beijing launched Made in China 2025, a large-scale industrial strategy intended to leapfrog the US and other Western powers in advanced technologies, including semiconductors.

The strategy made headlines, and was a major reason why Peter Huang, after a few years at a leading chip maker in Taiwan, decided to accept an offer from a Beijing-based company in 2017.

“I think I can see the future because if the Chinese mainland wants to make its own chips and become self-reliant, there will be good opportunities for people like me,” the 33-year-old said.

More opportunities and better pay are believed to be the key factors attracting skilled Taiwan engineers to the mainland.

According to a survey last year by 104 Job Bank, a human resource firm in Taiwan, the average annual salary for a mid-level manager in the chip industry in Taiwan is about NT$2 million (US$64,500), while mainland companies offer as much as NT$4.5 million.

Local governments on the mainland have also stepped up their own efforts to attract experienced workers from Taiwan. Under an initiative by the Fujian government, for example, mid-level managers with 10 years of experience in the Hsinchu Science Park can get a one-time subsidy of 1 million yuan (US$145,000) to relocate.

“To many of them, the money they could earn in China in three years is equivalent to what they could get in Taiwan in eight years,” one industrial insider said.

To Chen, the job was also hard to reject – now in a high-level position with a bigger salary, he can also fly back to Taiwan to meet his chip design team and his family once a month. His employer in the mainland is also looking to go public, and employees would likely be eligible for shares.

“That means I will be financially stable,” he said.

But Huang said that salary was not the major reason to move to Beijing. “Actually it’s not a good deal if you just measure it with money,” he said.

“I wanted to come because I believe there will be more opportunities here, and you can meet more people, which could also improve my capability and broaden my vision.

“Even if there’s little advantage in salary and living environment, like the pollution and the internet censorship, I still want to experience life here.”

While there have been concerns on Taiwan that more skilled talents would be “poached” by the mainland, both Huang and Chen said that the number of Taiwanese working in Chinese semiconductor companies remained small.

“Many people are watching and interested,” he said, “but very few eventually come because they don’t want to leave their family.”

- Previous Bigger problems loom for afghans: War, drought, diplomatic rifts deepen Afghanistan’s water crisis

- Next Chinese scientists guilty of ‘researching while Asian’ in Trump’s America