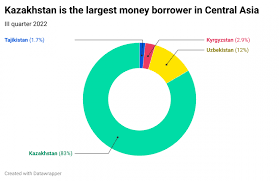

Kazakhstan speeds up borrowing abroad: this time in Eurobond market

By Alimat Aliyeva

Kazakhstan returned to the Eurobond market for the first time since 2015, placing an issue worth 1.5 billion US dollars for a period of 10 years with a coupon rate of 4.714%, Azernews reports.

The Eurobonds are listed on the London Stock Exchange and the Astana International Financial Center Exchange. Citi, JPMorgan, Societe Generale acted as international organizers, joint lead managers and bookrunners of the transaction, and BCC Invest JSC acted as the Kazakh organizer.

“The deal was preceded by a one-day virtual roadshow, which is available only to states with a high investment rating. The total order book showed steady growth, reaching almost 6 billion US dollars, which allowed the coupon rate and yield to be set at 4.714%, with a premium to US Treasury bonds of 88 basis points,” the report says.

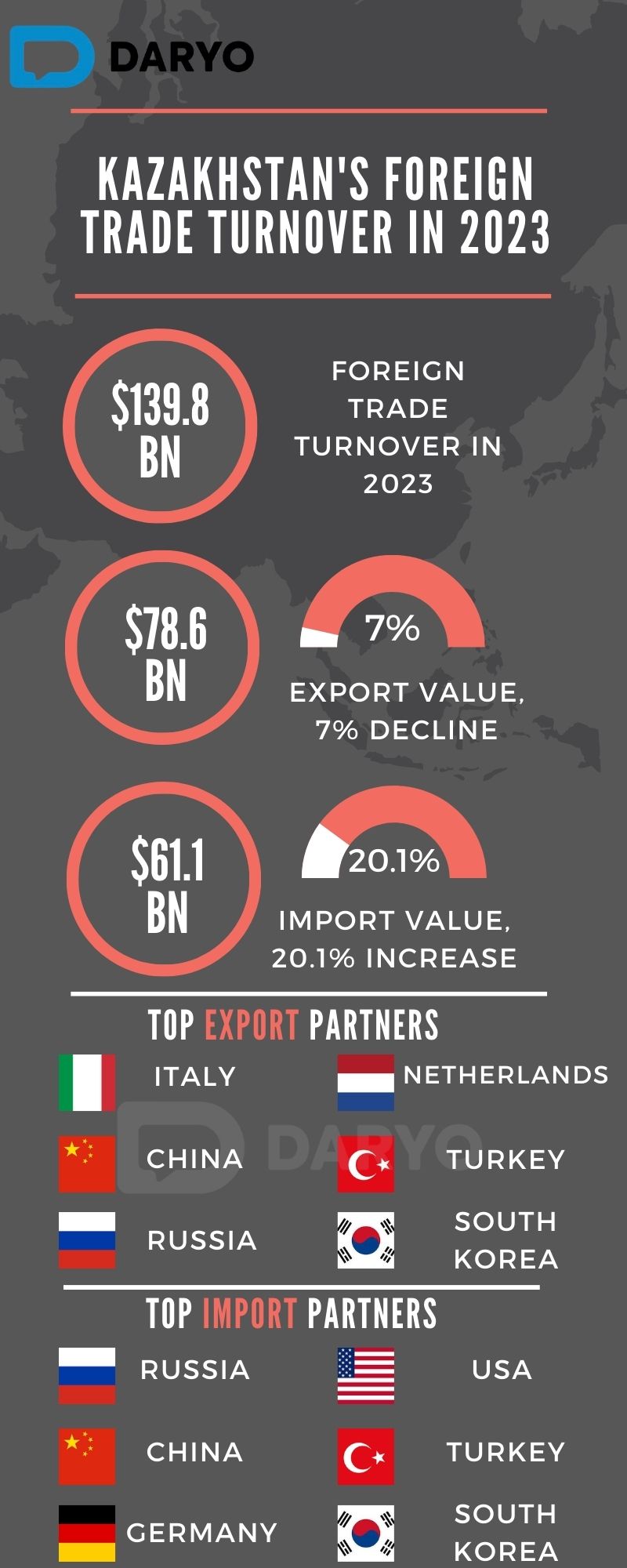

The agency notes that this issue of Eurobonds will strengthen the country’s financial stability and support its economic growth.

“In addition, favorable placement conditions will create a benchmark for entry into the international capital markets of other issuers from Kazakhstan, both quasi-governmental and corporate,” the information says.

- Previous Secretary General Gutyerish of UN to participate in BRICS summit in Russia’s Kazan

- Next Once seen as a Switzerland of MEast, Half a Centurty of Lebanon a Cursed Nation!? Wars Since 1975, Enemy Israel – 3 Wars Since 1982, Unbeliavable Level of Corruption, Bad Neighborhood, Horruble Managment and e.t.c.