One more point of conflict: Qatar sues UAE, Saudi, Luxembourg banks over riyal ‘manipulation’

Doha has accused the banks of currency manipulation in the months following the start of a blockade against Qatar.

Qatar has filed lawsuits in London and New York against three banks for allegedly plotting to undermine its currency and bonds.

The cases named the United Arab Emirates’ (UAE) First Abu Dhabi Bank (FAB), Saudi Arabia’s Samba Bank and Luxembourg-based Banque Havilland, a statement from Qatar’s government communications office said on Monday.

FAB is the largest lender in the UAE and Samba is one of the leading banks of Saudi Arabia.

Qatar said Banque Havilland tried to weaken its currency, the riyal, by submitting what the statement called fraudulent quotes to foreign-exchange platforms in New York allegedly intended to disrupt indices and markets where significant Qatari assets and investors are located.

The government statement did not go into details about the accusations against FAB and Samba Bank, saying only that they were “engaged in financial market manipulation”.

None of the banks had any immediate comment on Qatar’s accusations, nor was the extent of the damages being sought by Qatar clear.

Ongoing blockade

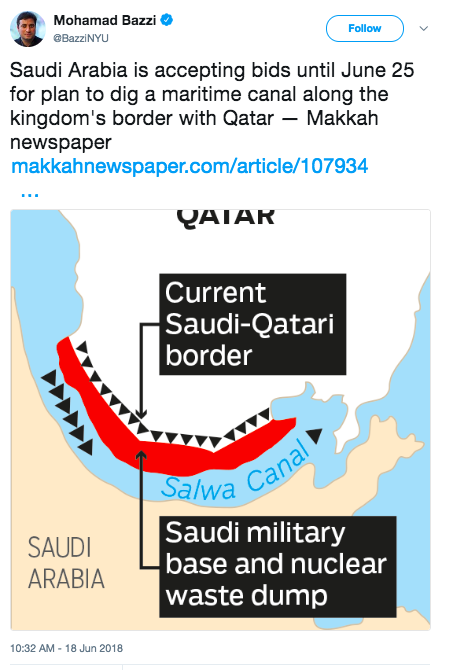

Qatar has been facing an economic and diplomatic blockade imposed by Saudi Arabia, the UAE, Bahrain and Egypt since 2017.

The quartet accuses Doha of backing “terrorist” groups and seeking closer ties with Saudi Arabia’s regional rival, Iran.

Qatar has repeatedly denied the allegations as “baseless”. It has also rejected a list of demands issued by the four countries as a prerequisite to lifting the blockade, denouncing it as an attempt to infringe Qatar’s sovereignty.

The lawsuits were filed based on an investigation launched by Qatar into market manipulation, according to the statement, which said that further legal action may be taken as the probe continues.

Doha claims that the boycotting countries’ actions were “designed to destabilise Qatar’s currency and financial markets in order to undermine confidence in Qatar’s economy”.

Qatar has already taken legal action against the four blockading countries before the International Court of Justice (ICJ), International Civil Aviation Organization (ICAO) and the World Trade Organization (WTO).

The riyal has been pegged to the US dollar at a rate of 3.64 for more than a decade, but in the initial months of the boycott, it traded as low as 3.8950 offshore before returning to normal levels.

With more than $300bn in central bank reserves and sovereign wealth fund assets, bankers say Qatar – a small but gas-rich emirate – has sufficient financial power to block attacks on its currency.

- Previous US labels Iran’s elite Revolutionary Guard Corps a ‘terror group’

- Next Support golden crop, fight anti-palm oil campaigns, Malaysians urged