Record trade surplus highlights Malaysia’s resilience

KUALA LUMPUR: Malaysia’s record trade surplus streak, now at 67 consecutive months, reflects the country’s successful push toward industrial upgrading and capital deepening – steps that may cause minor short-term fluctuations but ultimately strengthen long-term competitiveness, economists say.

While some regional peers have faced external shocks and trade deficits, Malaysia has consistently maintained a surplus for more than five years, highlighting its resilience and diversified export base.

Sunway University economics professor Dr Yeah Kim Leng said Malaysia’s broad trade structure has helped cushion the economy against external shocks.

He added that the US-China rivalry has indirectly benefited Malaysia through friend-shoring, the China+1 strategy, and other initiatives aimed at shortening and diversifying global supply chains.

“Besides its neutrality in geopolitical considerations, Malaysia’s expanded market access through various regional trade agreements such as the Regional Comprehensive Economic Partnerships (RCEP) has also increased its appeal as a regional production centre to global companies,” he told Business Times.

Dr Yeah noted that the trade surplus remained robust despite a temporary dip in May, when it narrowed to RM760 million, its lowest level since November 1997. This compares with a strong average monthly surplus of RM12.5 billion during the first 10 months of 2025.

He explained that occasional monthly trade deficits may arise as imports of capital and intermediate goods increase, supporting the country’s industrial transformation.

“With the ringgit strengthening and the lumpy nature of capital goods imports coupled with the strong pace of industrial upgrading and infrastructure development, monthly trade deficits may occur in 2026 and beyond, but annual surpluses are expected to remain intact,” he told Business Times.

“On an annual basis, Malaysia’s larger export base, which includes a sizeable natural resource commodity-based component comprising crude oil, natural gas, palm oil and timber, will still provide a comfortable surplus buffer.”

Samuel Tan, founder and chief executive officer of Olive Tree Property Consultants, said Malaysia’s trade surplus is likely sustainable in the medium term, though structural pressures are evolving.

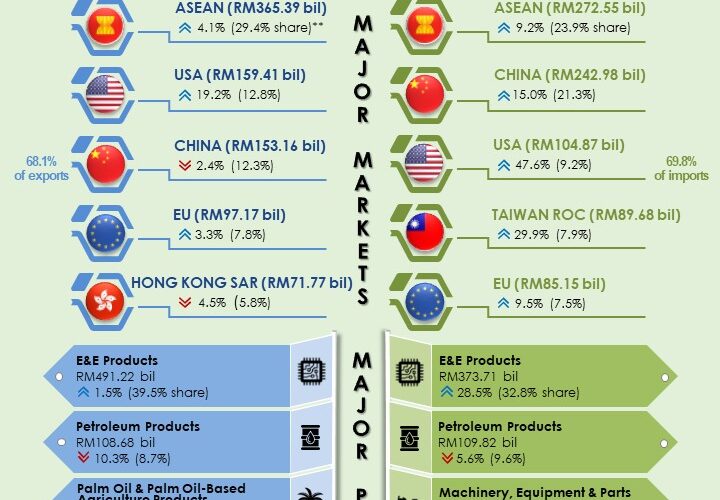

“Its sustainability hinges on the fundamental export strength driven by entrenched strengths in electrical & electronics (E&E) and commodity exports; high imports of machinery and components are used to produce higher-value goods for re-export. This should widen, not narrow, the future surplus if the industrial upgrade succeeds, and diversified markets with access to ASEAN, China, the US, and the EU provide demand stability,” he told Business Times.

Tan highlighted key risks, including commodity price volatility. “A sharp, sustained drop in palm oil or LNG prices could quickly erode the surplus.”

Global demand shocks are another risk, said Tan, adding that a deep recession in major markets such as the US, China or the EU would hit export volumes.

“If global demand weakens just as new capacity from these capital imports comes online, the surplus could narrow temporarily. Meanwhile, rising domestic consumption will cause a boom in consumer goods imports, which, if not matched by export growth, could pressure the surplus,” Tan said.

Economist Dr Geoffrey Williams cautioned that Malaysia’s trade performance remains vulnerable to volatility amid global uncertainty.

While the country has maintained a surplus for 67 consecutive months, he noted that the April–June period was relatively weak, with the surplus falling to RM759.9 million in May. The surplus also declined 70 per cent from October to November and was down 58.8 per cent year-on-year in November.

Williams warned that reopening Asean Regional Trade (ART) negotiations could prolong uncertainty into next year, which he described as unwise.

He noted that E&E products remain Malaysia’s largest export segment, growing 17.5 per cent from January to November. However, net trade in the sector declined six per cent.

While this may reflect retooling and upgrading, it could also be driven by imports of data centre-related equipment, which generates relatively few long-term jobs, with profits often repatriated overseas, he said.

“Data centres do not create many jobs after they are constructed and the profits are repatriated overseas so the shift to technology-based activities might be a double-edged sword,” he said.

Williams added that Malaysia benefited significantly from the ART through zero-rated tariffs on more than 2,000 products, but further gains would require addressing non-tariff barriers. Any tariff concessions extended to the United States, he said, should be offered to all trading partners in exchange for reciprocal tariff and non-tariff reductions.

Despite strategic investments in AI, aerospace and logistics, Williams said progress remains gradual. As a result, Malaysia is likely to continue relying on traditional trade pillars such as E&E, oil and gas, and palm oil, alongside services, tourism and Islamic finance, in the near term.

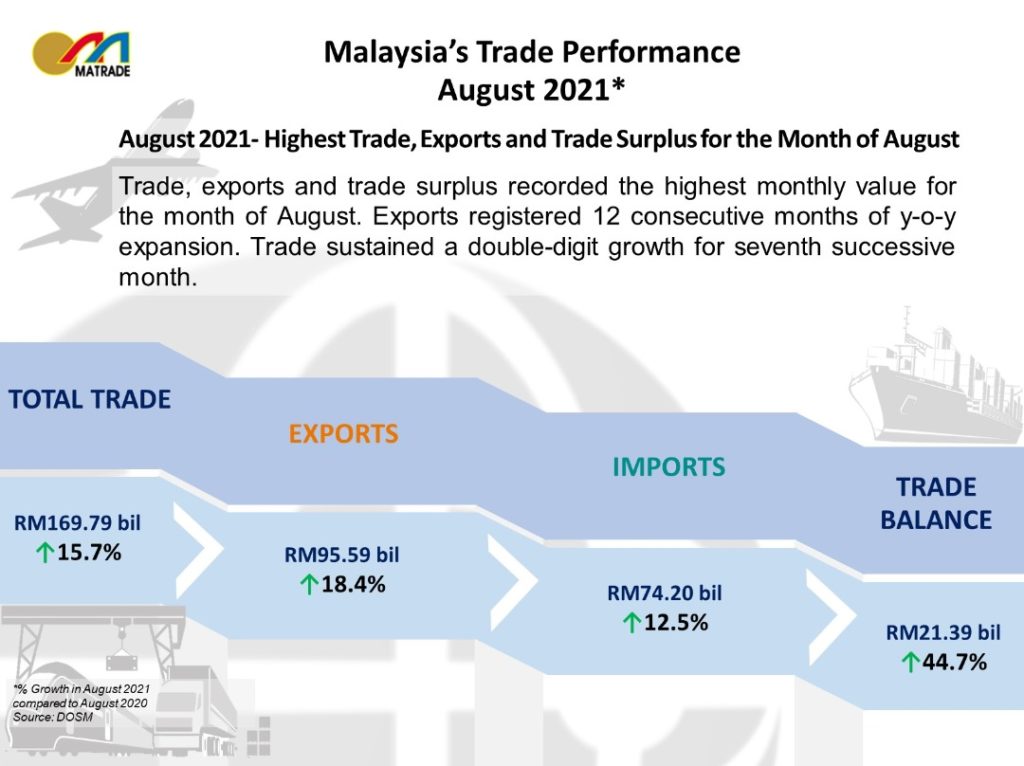

Positive Growth

Malaysia recorded its highest-ever cumulative trade value for January to November, with total trade rising 5.8 per cent to RM2.78 trillion, while the trade surplus expanded 10.7 per cent to RM132.56 billion.

The Malaysia External Trade Development Corp. (Matrade) attributed the performance to Malaysia’s resilience as a diversified trading nation and its ability to navigate a challenging global environment.

In November alone, total trade grew 11.1 per cent year-on-year to RM263.83 billion. Exports rose seven per cent to RM134.97 billion, while imports surged 15.8 per cent to RM128.86 billion, resulting in a trade surplus of RM6.12 billion.

Elaborating on the performance, Matrade said the narrower surplus in November was largely driven by a sharp increase in imports of capital and intermediate goods, reflecting strategic industrial upgrading rather than weakening export momentum.

Imports of capital goods jumped 56.8 per cent to RM20.81 billion, led by E&E infrastructure for data centres and artificial intelligence (AI) applications, including servers, transmission equipment, and high-end computing machinery.

Imports of intermediate goods rose 5 per cent to RM66.43 billion, supported by strong demand for integrated circuits and micro assemblies, reflecting continued high manufacturing activity and a solid pipeline for future exports.

Matrade described the moderation in the trade balance as a “positive narrowing”, driven by deliberate capital investment.

Bank Muamalat Malaysia Bhd chief economist Dr Mohd Afzanizam Abdul Rashid said the sustained surplus is underpinned by sectors where Malaysia has clear comparative advantages, particularly E&E products and commodities such as palm oil and liquefied natural gas.

“These are the sectors that have a comparative advantage. In the case of semiconductors, the Malaysian government is actively looking for ways to go into higher value-added activities such as design and development. This is being reflected in the formulation of integrated circuits in Selangor and Penang,” he told Business Times.

On the surge in capital goods imports, Afzanizam said such patterns are typically cyclical rather than structural.

“Firms will plan their capital expenditure and during the execution, there will be sizeable imports of capital goods. But thereafter, firms will evaluate their return on investment and payback period. They need to see their investment would start to produce returns,” he said.

Capital Imports as a Catalyst for Competitiveness

Dr Yeah said the rise in capital goods and high-technology imports reflects strategic investment rather than economic weakness.

“This is because the country’s industries are dependent on more advanced technology, where a large portion is brought into the country through foreign direct investment, especially in E&E and advanced manufacturing,” he said.

Much of this technology inflow is driven by foreign direct investment, which remains central to Malaysia’s industrial ecosystem. As firms upgrade production lines and adopt more advanced processes, productivity gains are expected to strengthen the country’s export position over the medium to long term.

On bridging the skills gap, Dr Yeah said that as Malaysia moves toward a high-technology, high-value economy, human capital constraints have become more pronounced.

“Ensuring an adequate supply of skilled workers that meets industry needs is a crucial policy imperative. It requires the nation to shift from its policy that focuses on unskilled labour to one that emphasises comprehensive support for skills upgrading, longer internships and targeted industry placement and training programmes for local graduates,” he said.

Without these reforms, the benefits of industrial upgrading may not fully translate into sustainable growth or quality job creation.

Investing for the Next Decade

Looking ahead, Dr Yeah said Malaysia’s investments in AI infrastructure, advanced electronics, aerospace, Industry 4.0 technologies and logistics modernisation will be key to long-term competitiveness.

“The imports of capital goods and technology may cause a temporary reversal in trade balance but given the dominance of intermediate and capital goods, that accounts for over 80 per cent of total imports, it is not a structural issue but a cyclical one.

“In fact, the shifts in the trade structure and temporary trade deficits are indicative of an acceleration in the desired structural upgrading and competitiveness of the economy,” he said.

Meanwhile, Tan (Olive Tree) said that the significance for long-term competitiveness is the development of AI infrastructure.

“Not just a sector, but a general-purpose technology. AI adoption across agriculture, manufacturing, finance, and healthcare can drive massive productivity gains economy-wide.

“Malaysia must move into a high-precision, high-trust, long-cycle industry. It develops deep-tier supplier networks and an ultra-skilled workforce, with spillovers to automotive, medical devices, and defence.

“We should create advanced logistics such as port and digital logistics to transform Malaysia from a production hub to a global distribution and command centre, capturing value from inventory management, regional HQs, and trade facilitation services.

“For growth in the next decade, these capital-intensive investments will increase imports of specialised equipment. Long-term, they should improve the services trade balance (export of engineering, digital, and logistics services) and support higher-value goods exports,” he said.

For the domestic economic growth, Tan said Malaysia must create high-wage jobs, stimulate domestic innovation, and increase the economy’s resilience to shocks.

The goal is to create a virtuous cycle: high-tech investment leading to higher productivity and higher wages and higher domestic demand and innovation capacity.

“These investments require consistent policy commitment beyond political cycles and patience with capital allocation. The ultimate success will be measured by whether they spawn globally competitive Malaysian-owned firms, not just host facilities for foreign multinational enterprises,” Tan said.

- Previous Sabotage conspiracy in Turkish media: West Libya’s army chief and 3 others killed in plane crash near Ankara

- Next Japanese PM Takaichi: We must be prepared for possible long military conflict