US could lose a key weapon for tracking Chinese and Russian subs

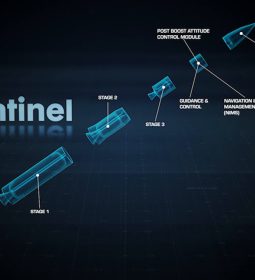

WASHINGTON — A key tool in the U.S. Navy’s fight against Russian and Chinese submarines weighs eight pounds, is three feet long and it doesn’t even explode.

The sonobuoy is an expendable, waterborne sensor that has been air-dropped by the hundreds to detect enemy subs, a go-to capability for America and its allies for decades. The Pentagon wants to buy 204,000 sonobuoys in 2020, a 50 percent spending increase over 2018.

But just as the U.S. military needs them most, this critical capability is under threat, and it’s got nothing to do with an enemy nation. Pentagon says it may no longer have a reliable supplier, according to officials who spoke to Defense News.

Like so many systems in the Pentagon’s arsenal, America has just one proven supplier. In this case, it is a joint venture between the United States and the UK called ERAPSCO. The Pentagon says ERAPSCO will dissolve by 2024 and that neither side of the partnership — Sparton Corp., of Schaumburg, Illinois, and Ultra Electronics, of Middlesex in the U.K. — will be able to make the necessary investments to produce the capability independently.

It’s an “acknowledged weakness” in the industrial base that required the Pentagon find a solution, said Eric Chewing, a top Pentagon official who was until January the head of the Pentagon’s industrial policy office.

As a result, U.S. President Donald Trump in March signed a memo invoking the DPA Act to declare domestic production for the five types of AN/SSQ sonobuoys “essential to the national defense” and grant the Pentagon authorities to sustain and expand the capability. The Air Force, in anticipation, issued a market research solicitation to find suppliers beyond ERAPSO.

The Pentagon requires “comprehensive individual production lines … for the five sonobuoy types, but the two companies would “require assistance to establish independent production lines,” said DoD spokesman Lt. Col. Mike Andrews.

“Due to the significant efforts and expenditures, it is unlikely that either the JV partners (or any other entity) will be independently able to make the necessary investments to develop and produce the required sonobuoy demands by 2024,” Andrews said, adding that “DoD intervention into the market is necessary.”

A draft of the Pentagon’s Nuclear Posture Review confirms the existence of an underwater nuclear drone made and operated by Russia, a capability the U.S. Defense Department had not previously publicly acknowledged.

A key tool

A staple of the P-8 and the MH-60R Sea Hawk helicopter, multi-static active coherent, or MAC, sonobuoys have a battery life of about eight hours. Because they’re tracking submarines that are in constant motion, a sonobuoy dropped in one place may become useless soon after. If a P-8 is hunting blind, its full cache of 120 might get used up in a single mission and abandoned.

“It depends on how much area the P-8 needs to search and how quickly the target submarine is moving,” said naval analyst Bryan Clark, of the Center for Strategic and Budgetary Assessments. “The search area for the system depends on the detectability of the target submarine. If the P-8 is conducting a barrier search, it may not need to expend that many sonobuoys. If it is tracking a moving, quiet submarine, though, it could use up its entire sonobuoy load and need to come back for reloading.”

With Russian and Chinese subs on the rise, anti-submarine forces have been unexpectedly busy in recent years, burning through supplies of all kinds of sonobuoys.

The Navy’s sonobuoy budget climbed from $174 million in 2018 to $216 million in 2019 to $264 million in the 2020 budget request. In 2018, the Pentagon asked Congress for a $20 million reprogramming for sonobuoys for 6th Fleet, after including $38 million for sonobuoys on its unfunded priorities list.

Analysts agree that sonobuoys will only become more important to the U.S. and its allies as Russia and China’s sub technology advances.

Thirteen NATO allies, including the United States, signed onto a plan to jointly pursue unmanned systems aimed at mine and sub hunting, a field where the U.S. has made big strides.

“With the new generation of quiet submarines being fielded by Russia and China, traditional approaches to [anti-submarine warfare] using our submarines or surface ships are becoming less successful,” Clark said. “Our ships and submarines have to get too close to the Russian or Chinese submarine to hear them on passive sonar, and ship and submarine active sonars are relatively short range and expose the transmitting platform to detection.”

Russia’s subs are the most capable, and Moscow is devoting considerable resources to modernizing them, said Nick Childs, of the International Institute for Strategic Studies. China’s subs are “technologically still behind the curve,” but the country is investing heavily to become a competitor in underwater capabilities.

“Russia’s submarine force is likely to remain the most potent and challenging of its naval arms, with continued significant investment, and to the extent that its submarines activities continue, [the U.S. Navy will] be demanding of such things as sonobuoys,” Childs said.

Industrial challenge

ERAPSCO produces four of the five types of sonobuoys, which the Navy is in negotiats to buy on a four-year contract through 2023. Looking to boost competition, the service has been pushing Sparton and Ultra Electronics to dissolve the partnership and sell sonobuoys independently at the end of this contract.

But Sparton disclosed in an annual report last year that “due to the significance of the effort and expenditures required, there can be no assurance that Sparton, or both of the ERAPSCO joint venture partners,” would be able to meet the Navy’s requirement independent of one another.

Sailors load sonobuoys onto an MH-60R Sea Hawk helicopter on the flight deck of the Arleigh Burke-class guided-missile destroyer USS Oscar Austin (DDG 79) during flight operations May 10, 2017. (US Navy/Sean Spratt)

Facing financial troubles, Sparton agreed to be acquired by Ultra Electronics in July 2017, but the companies cancelled their $234 million deal less than a year later, after the U.S. Department of Justice planned to block it over antitrust concerns.

Sparton then sold itself to Cerberus Capital Management, a New York City-based private equity firm specializing in distressed assets, for $183 million, roughly a year later. Cerberus owns major brands like office supply retailer Staples and grocery chain Safeway, but also defense contractors DynCorp, and as of December, Navistar Defense.

Andrews, the Pentagon spokesman, laid out the government’s concerns in a statement to Defense News.

“The DoD/DoN anticipates purchasing over 204,000 sonobuoys per year across the five types. To meet this demand, the DoD/DoN requires secure and stable sonobuoy suppliers,” Andrews wrote. “Based on these requirements and need for a stable sonobuoy industrial base, comprehensive individual production lines are required for the five sonobuoy types.

“This Defense Production Act Title III project is intended to sustain and reconstitute the industrial base for U.S. Navy sonobuoys and ensure at least two sources of sonobuoy manufacturing,” Andrews said, adding: “For these reasons, President Trump, DoD, and DoN found use of DPA funds, coupled with industry investment, to be the most cost-effective, expedient, and practical approach to meet critical AN/SSQ series sonobuoy capability requirements.”

The Defense Production Act, invoked in Trump’s memo, allows the department to give funding to producers of key industrial needs. It’s something the department is trying to use more in the wake of a major industrial base study, released last year.

“Part of what we wanted to do was inject capital to make sure there was support to the industrial base so that you could have two or more viable suppliers,” Chewning, the former industrial policy head, told Defense News recently. “It just made sense given the existing shortfall, and what had been allowed to happen within the industrial base, that we used the DPA Title III authorities to create incentives to expand production and strengthen.”

Chewning, who is now chief of staff to Acting Secretary of Defense Patrick Shanahan, said that he was going off information gleaned from before he left the Industrial Policy job. He described the situation as being “active, not reactive.”

Ultra Electronics and Sparton declined to comment on the future of their joint venture.

“Ultra Electronics remains committed to our US Navy partners to ensure the continued success of sonobuoy production and future development efforts. Our focus is, and will continue to be set on meeting the growing ASW requirements of the fleet,” the company said in a statement.

If the United States was open to buying sonobuoys outside its borders, there are other Western producers of the technology, including close allies Britain and France. But those production lines are being tapped by others, and with the U.S. likely to be the biggest procurer of the systems going forward, losing a U.S. internal production capability could lead to shortages.

And fundamentally, naval analysts Childs and Clark agree having a domestic supplier for the U.S. is vital, both for production needs and for, as Childs puts it, remaining “at the cutting edge of what is a critical technology area.”

David Larter in Washington contributed to this report.

- Previous US-China Geopolitics Competition in the Pacific: US Navy’s new assault ship to bolster aviation component in Japan

- Next Palestine-Israel conflict: Reduction of Gaza fishing zone an ‘illegal collective punishment’

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/YGRLJ7FYWBFLRK3FB2UTA22TZU.jpg)