Will Mongolia kick out Canadian and Australian mining company out of country: Lawmakers seek to rewrite Oyu Tolgoi deal

A group of Mongolian legislators has recommended one of the agreements underpinning Rio Tinto’s Oyu Tolgoi copper mine should be scrapped and another changed, adding to the giant project’s political problems, Reuters reports.

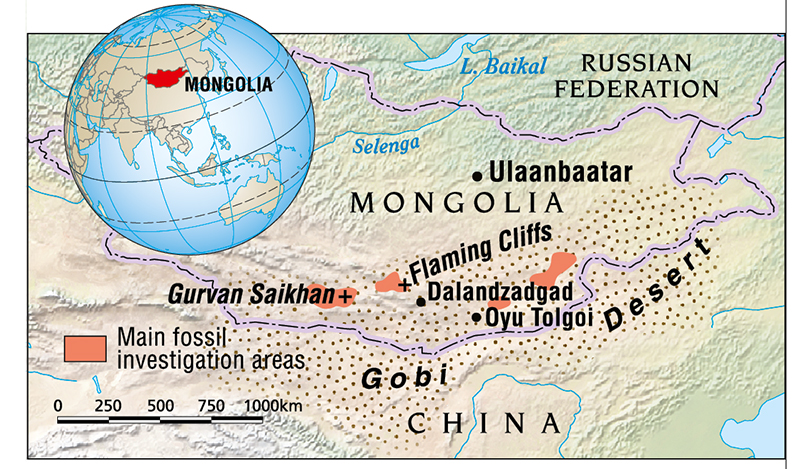

The Gobi desert copper deposit promises to become one of Rio Tinto’s most lucrative properties, but it has been subject to repeated challenges from politicians who argue the spoils of the country’s mining boom are not being evenly shared.

It has also been at the centre of an anti-corruption investigation that has seen the arrest of two former prime ministers and a former finance minister.

The original 2009 Oyu Tolgoi Investment Agreement granted 34 percent of the project to the Mongolian government and 66 percent to Canada’s Ivanhoe Mines, now known as Turquoise Hill Resources and majority-owned by Rio Tinto.

Nationalist politicians have repeatedly called for the deal to be adjusted in Mongolia’s favour.

Terbishdagva Dendev, head of a parliamentary working group set up last year to review the implementation of the Oyu Tolgoi agreements, told reporters this week the group had concluded the original 2009 deal should be revised.

A 2015 deal known as the Dubai Agreement, which kickstarted the underground extension of the project after a two-year delay, should also be scrapped entirely, he said.

“Of course there will be international and local pressure, though if we do have rule of law … the agreements should be amended for good,” he said in a separate television interview.

Rio Tinto did not immediately comment on the issue when contacted by Reuters.

A lawyer involved in Mongolian mining deals speaking on condition of anonymity said opponents of the original agreement argue the Dubai Agreement made changes to the 2009 deal and should therefore have been subject to full parliamentary approval. Instead it was just approved by the prime minister.

The 200-page review has been submitted to Mongolia’s National Security Council as well as a parliamentary standing committee on economic matters. It is unclear when or if its recommendations will be implemented.

“It will be very hard to terminate the underground mine plan, since it must be done by mutual agreement,” said Otgochuluu Chuluuntseren, advisor at Mongolia’s Economic Policy and Competitive Research Center and a former government official.

“Also foreign investors who were participating in the project finance might intervene in the process to protect their interests,” he told Reuters, adding that it could also damage investor sentiment for years.

The flagship Oyu Tolgoi project helped spur a mining boom that drove economic growth up to double digits from 2011-2013, but a rapid collapse in foreign investment and falling commodity prices saw Mongolia plunge into an economic crisis in 2016.

Mongolia was also embroiled in a row with Rio Tinto over tax and project budget issues that saw Oyu Tolgoi’s expansion put on hold. A series of other disputes with foreign miners also weakened investor sentiment.

- Previous No summit with China’s Xi Jinping until a deal to end trade war is final, Donald Trump says

- Next Oman calls on Arabs to ease Israel’s ‘fears for its future’