A US-China trade deal won’t be a win for global markets if Beijing shifts its trade surplus to other countries

- Imagine what happens if China commits to wiping out its share of the US’ trade deficit – a chain reaction of stronger US dollar, higher US interest rates, and a redistribution of Chinese imports could bring pain to the rest of the world

Nevertheless, much less has been discussed about how the world economy and financial markets would adjust to a possible Sino-US trade deal. In this regard, the financial and economic implications of a China-US trade deal can be very disruptive for the world economy and global financial markets.

If so, the expected trade deal could cause serious economic and financial market dislocations. How so?

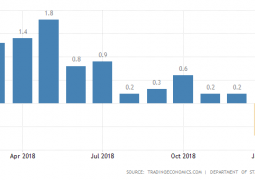

To see the disruptive impact of such a bilateral trade deal, a thought experiment is in order: suppose that China is forced to increase its purchases of American goods and services so much so that the entire China-US bilateral trade deficit would be wiped out in one shot. In this case, China’s imports from the US would surge by more than US$400 billion, or 2 per cent of US gross domestic product, which undoubtedly represents a huge boost to aggregate demand for the US economy, thus driving up US economic growth sharply.

The potential problem, however, is that the expected surge in Chinese imports would almost close up America’s entire current account deficit and this would lead to a global dollar shortage. As a result, market forces would likely drive up the dollar to such a level where US exports to other parts of the world would be reduced, thus “re-creating” a trade or current account deficit.

Meanwhile, with the US economy already running at or close to full capacity, a surge in American exports to China could create inflationary pressures, forcing the Fed to raise rates to weaken domestic demand.

In the end, either higher short rates or a stronger US dollar or both would act to slow down the US economy and ensure that America’s trade balance is more or less unchanged. Nevertheless, the side effect of these adjustments would be very problematic for the rest of the world economy.

To make matters even worse, if China begins to face a current account deficit as a result of the expected import surge from the US, Beijing would have to opt for reducing China’s imports from other countries to keep its external balance under control. This import redistribution could add more economic pain for the rest of the world economy, which would already be pressured by a rising dollar and US interest rates.

In this scenario, a Sino-US trade deal could simply amount to a zero-sum game in the short term: a gain for the US, a loss for the rest of the world, and indifference for China. Over time, however, US trade deficit simply shifts from China to other countries. This shifting process would be fraught with financial and economic risk and in the end, it would represent a net efficiency loss in the world supply chains.

The actual outcome of the expected China-US trade deal will largely depend on how it is structured and what China’s commitments are. In all likelihood, China’s commitment to buy more American goods is likely to be spaced out over time, and as such the economic and financial impact of the expected trade deal may take some time to play out.

China-US trade imbalance is the natural result of global supply-chain evolution, and eliminating this imbalance is too disruptive for every country involved

Nevertheless, policymakers and investors need to realise that a China-US trade deal may not be a panacea for global growth. There could be a dark side to it.

To avert or minimise the adverse impact of a China-US trade deal on the rest of the world economy, the Sino-US trade deal should focus on Beijing’s protective trade and investment policies rather than bilateral trade imbalance. The China-US trade imbalance is the natural result of global supply-chain evolution, and eliminating this imbalance is too disruptive for every country involved.

However, making sure that Beijing plays by the rules and levels off the playing field for foreign businesses and suppliers would represent a net gain for the world economy, benefiting all.

South China Morning Post

- Previous Opinion from China says: “World should fear US decline not China rise”.

- Next Iran’s Revolutionary Guard ‘shoots drone footage’ of US warships