A US-China trade war deal, coupled with central bank monetary policy easing, could buck global slowdown predictions

- The trade war has worried central banks enough to prompt interest rate cuts. However, the effect of this will only be felt later and could coincide with phase one of a US-China trade settlement

Rather than inferring from the tone of central bank and IMF pronouncements that the risks to the world economy are on the downside, markets might adopt a more positive attitude.

After all, markets are necessarily more interested in where prices are going rather than where they have been, and if there is some light at the end of the tunnel as regards US-China trade differences, that will give the global economy a material fillip.

But even the most pessimistic commentator would have to acknowledge that some form of trade deal would give Hong Kong’s economy something of a boost.

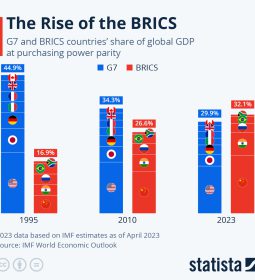

More generally, markets could well conclude that, at the present juncture, it might actually suit China to cement some kind of trade deal with the United States.

Only last week, new data from China’s National Bureau of Statistics showed the manufacturing purchasing managers’ index at 49.3 in October.

That was below the consensus forecast of analysts polled by Bloomberg for an unchanged reading from September’s 49.8. Some form of trade war settlement would surely improve confidence among Chinese manufacturers.

Given that the US will be a major source of the kind of inward foreign investment China wishes to encourage, Beijing might decide this is the optimal moment to build bridges with Washington over trade differences.

If a “phase one” trade deal is being finalised, it might be that tariffs have already topped out.

Yet, in explaining the logic behind last week’s US interest rate cut, Federal Reserve chairman Jerome Powell emphasised that “weakness in global growth and trade developments have weighed on the [US] economy”, while acknowledging that if a “phase one” trade deal is signed off “that would bode well for business confidence and perhaps activity over time”.

Additionally, as Powell stated, “monetary policy operates with a lag”, so the full effects of the Fed’s moves “will be realised over time.”

Consequently, the effects of US monetary policy easing, which itself has been materially shaped by Fed concerns about the trade war, will only become evident in the coming months, just as the first-phase deal has potentially been achieved. Thus, the world economy could end up with a double boost.

Although august institutions such as the IMF and the OECD have cut their global economic forecasts, there is room for a more positive narrative that might prove persuasive to markets. Even a partial trade deal will be beneficial to the global economy.

With that in mind, markets should look beyond the gloom. A more upbeat outlook might prove more profitable.

- Previous Afghan Election Commission to Start Recounting Votes

- Next Crown of the British Empire will be divided again: India moves to divide occupied Jammu and Kashmir state amid protests, attacks