Dollar to Benefit if $2.5 Trillion in Cash Stashed Abroad Is Repatriated

Part of $2.5 trillion in profits held overseas by companies such asApple Inc. and Microsoft Corp. could be heading back to the U.S., a move analysts say could further fuel the U.S. dollar’s powerful rally.

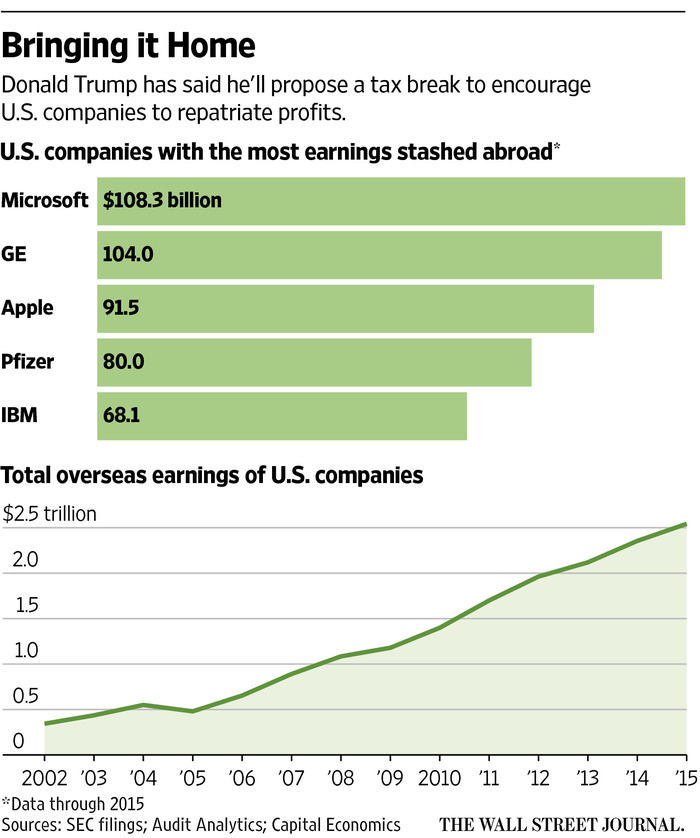

U.S. corporations have been holding billions in earnings and cash abroad to avoid paying a 35% tax that would be levied whenever the money is brought home. President-elect Donald Trump has said he would propose a one-time cut of the repatriation tax to 10% to lure money back to the U.S. that can be spent on hiring, business development and funding Mr. Trump’s fiscal stimulus proposals.

Market optimism that the stimulus plan can generate U.S. economic growth and push the Federal Reserve to raise interest rates has buoyed the dollar against a basket of major trading partners toward 14-year-highs since the Nov. 8 presidential election.

Now, some say the prospect of companies repatriating perhaps hundreds of billions of dollars could offer more impetus to the U.S. currency’s rally.

“However small, however big this flow of money will be, it will be positive for the case of dollar strength,” said Daragh Maher, head of U.S. foreign-exchange strategy for HSBC Holdings. “There will most likely be an inflow into dollars.”

When a company repatriates earnings from abroad, it may have to exchange the local currency for the U.S. dollar. The $2.5 trillion hoard of overseas earnings is highly concentrated in the technology and pharmaceutical sectors, according to Capital Economics. Microsoft held about $108 billion in earnings overseas as of 2015, while pharmaceutical giant Pfizer Inc. had $80 billion. General Electric Co. had $104 billion overseas, according to Capital Economics. Analysts note that many companies already hold their overseas earnings in U.S. dollar assets, which would mute the demand for dollars.

Representatives for Microsoft, Pfizer and GE declined to comment. A representative for Apple didn’t immediately respond to a request for comment.

ENLARGE

ENLARGEThough companies typically don’t disclose the composition of their overseas earnings, analysts expect the euro, British pound and Japanese yen would come under pressure if repatriations pick up.

The U.S. last introduced a one-time tax cut for repatriations a decade ago, under the Homeland Investment Act of 2004. More than $360 billion was repatriated, according to Internal Revenue Service data, helping drive the dollar up 13% against a basket of six major peers in 2005, along with tighter U.S. monetary policy.

A similar tax cut “is probably the lowest hanging fruit of all the fiscal measures Mr. Trump has proposed,” said Mark McCormick, head of North American foreign-exchange strategy at TD Securities. “Democrats, Republicans, many people have found this a very easy policy to pursue.”

Mr. McCormick thinks the repatriation tax could be passed by Congress as early as 2017, though he expects the impact on the dollar to be relatively modest since many companies already hold their earnings in U.S. dollars.

A 2011 report from Congressional Research Service, drawing on data from 27 U.S. multinational companies, said that 46% of their overseas earnings were in U.S. dollar assets.

TD estimates that a repatriation “holiday” would spur around $330 billion in inflows, though the bank thinks only $100 billion would need to be swapped for the dollar.

Analysts at Bank of America Merrill Lynch estimate closer to $400 billion in foreign currencies would need to be exchanged for the dollar. Given the “potentially significant” foreign-exchange moves, they have recommended clients make bets that the dollar will rise against European and Asian currencies.

If Congress makes the repatriation tax mandatory, unlike the optional Homeland Investment Act tax, both banks say inflows into the dollar would be much larger.

Mr. McCormick sees another reason why the repatriation tax would be a boon for the dollar. It would likely shrink the U.S.’s $120 billion current-account deficit, making assets in the U.S. more attractive to overseas investors and supporting the dollar.

“Growth and interest rates are already favoring the U.S.,” he said. “If you get more capital inflows, that’s going to be very good for the dollar.”

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

- Previous Pakistan PM Sharif names General Bajwa as new army chief

- Next Rodrigo Duterte’s Most Contentious Quotations