EU messes again: EBRD Downgrades Kazakhstan’s 2025 GDP Forecast

According to the EBRD, the downward revision is largely due to Kazakhstan’s GDP growth in the first quarter being driven primarily by higher oil output at the Tengiz field. While this expansion has supported short-term growth, the bank questions the sustainability of oil production as a long-term driver, particularly under current OPEC+ production limits.

Oil Output and Constraints

Tengizchevroil (TCO), the operator of the country’s largest oil field, increased daily production at Tengiz to a record 870,000 barrels in January 2025, up 45% from the 2024 average. Output climbed further to 950,000 barrels in March, before dipping slightly to an average of 884,000 barrels per day in early April. Industry projections suggest production may eventually reach one million barrels per day. However, the EBRD cautions that such gains may be constrained by Kazakhstan’s obligations under the OPEC+ agreement.

In addition to concerns about oil production, the bank notes the risk of declining demand for Kazakh oil and metals, key exports, especially from China, one of Kazakhstan’s main trading partners.

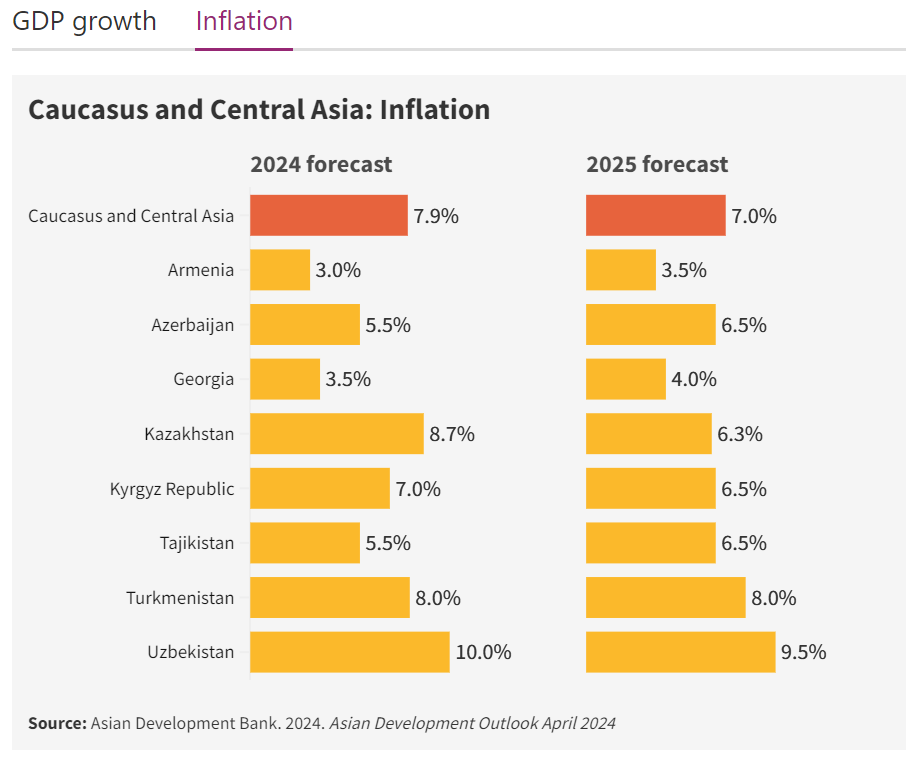

Inflation and Domestic Demand

Rising inflation presents another significant challenge. Consumer prices rose 8.9% in January, 9.4% in February, and hit 10% in March, the highest level since November 2023. In April, inflation climbed further to 10.7%, raising concerns about the erosion of domestic purchasing power.

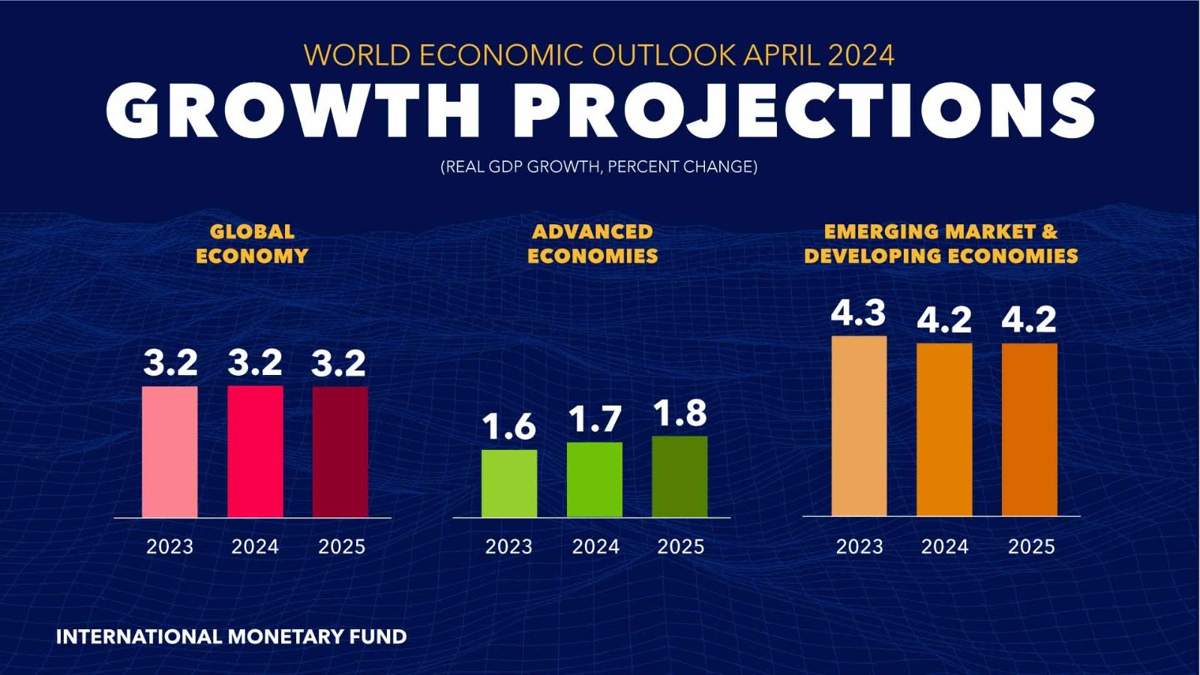

Broader Economic Indicators

Despite the EBRD’s revised forecast, the Ministry of National Economy reported on May 12 that Kazakhstan’s GDP grew by 6% in the first four months of 2025. For the January-March period, growth was recorded at 5.8%, supported by a range of sectors: transport (22.4%), trade (7%), agriculture (3.9%), and communications (2.6%).

Growth in the transport sector was driven by an increase in freight volumes via rail and pipeline, accounting for 20.5% and 19.6% of sectoral output, respectively. Wholesale trade expanded by 7.4%, and retail trade by 6.1%.

Outlook

As previously reported by The Times of Central Asia, several analysts view ongoing volatility in global markets as indicative of a looming “perfect storm” for Kazakhstan’s economy. This sentiment is echoed in the EBRD’s cautious outlook, highlighting a convergence of external and internal pressures on the country’s economic stability.

- Previous €12 Billion in New Projects are in talks of Uzbekistan and EU

- Next Emirati National Oil Company Joins Offshore Gas Project in Turkmenistan