Why Pakistan exports only $25bn a year? What’s missing in Pakistan’s export promotion policy?

The low value-added nature of exports is due to the limited focus on structural issues.

Former Minister for Finance and Economic Affairs Dr Hafiz Pasha notes that the decline in Pakistan’s “ability to service external debt … is clearly demonstrated by the phenomenal increase in the external debt to exports ratio.”

Based on our calculations, the external debt to exports ratio has worsened from 246 per cent of exports in FY13 to 427pc in FY19. This has come to haunt the economy as the government continues to adopt demand compression measures to contain the balance of payments crisis. While this may be unavoidable, the government must formulate appropriate export-promoting policies if Pakistan is to avoid another similar crisis.

At a macro level, both the previous and current governments have taken several steps towards promoting exports. The most important of these measures is the depreciation of the currency exchange rate, which was started in December 2017.

One of us shows that all of the slowdown in quantity of exports between 2015 and 2018 can be explained by the appreciation of the real effective exchange rate. Since then, exchange rate devaluations have helped to promote exports.

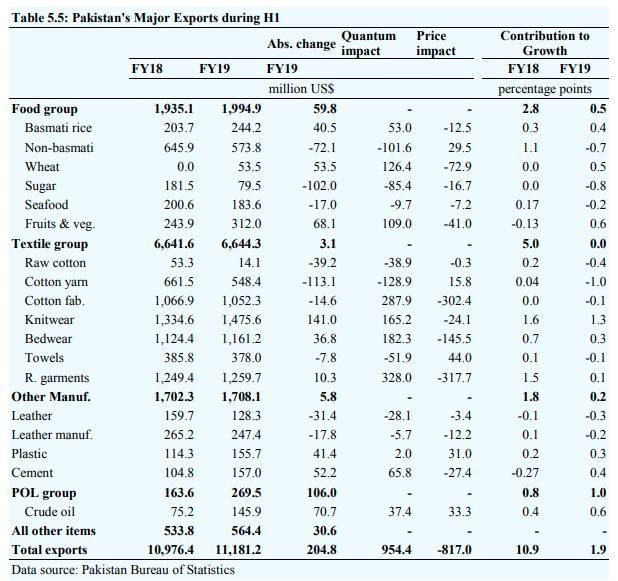

The State Bank of Pakistan (SBP) data shows that the quantity of exports has increased significantly during the first half of FY19. SBP further reveals that exports (in rupee terms) have increased by 24pc year-on-year over the same period.

—State Bank of Pakistan

The resolution of refunds has been a long-standing demand of exporters. It is easy to appreciate that business revenue is the cheapest source of finance available to any business. However, with funds stuck at the Federal Board of Revenue, firms had to rely on expensive external finance to run business operations.

The measures listed above should continue to have a positive effect on exports in the coming months. On average, it takes between four to six quarters before exports (in terms of quantity) respond to changes in prices.

However, despite significant improvement in the quantity of exports, the SBP data demonstrates that the year-on-year increase in dollar value of exports has remained minimal at 1.9pc for the first half of FY19. FY19 does not point to any increase in the dollar value of exports compared to FY18 either.

This is because, since most of Pakistan’s exports are low value-added, exporters can only compete in the international market by lowering the dollar price of their products. The implication is that, while the quantity of exports increases, the dollar value does not increase significantly.

Structural constraints

The low value-added nature of Pakistan’s exports is due to the limited focus by successive governments on structural issues.

These include the lack of focus on developing human capital necessary for high value-added production, poor linkages between high-tech defence industries and the private sector, a lack of emphasis on ensuring industry-wide standardisation and the limited access to neighbouring markets.

The low value-added nature of Pakistan’s exports directly relates to the availability, or lack thereof, of human capital. Naqeebz Consulting finds that 78pc of employers (respondents) are dissatisfied with the quality of fresh graduates. This is concerning as it limits firms’ ability to produce high value-added products.

Pakistan can benefit from the experience of advanced countries in this regard. For example, most engineering degrees in the United Kingdom provide placement opportunities as part of their degree programmes. An alternate route of vocational training and a government-sponsored apprenticeship programme is designed to allow the apprentice to spend most of her time with an industrial partner. By the time these students graduate, they are skilled and become an active part of the UK’s workforce.

Industrial linkages between defence and the private sector are factors deserving policymakers’ attention as well. Researchers at the University of California (Berkeley), Harvard and London School of Economics and Political Science show that an increase in defence-related research and development spending has positive spillover effects on productivity.

The domestic industry in the UK also benefits from government funded defence projects. Centres like the Forming Institute and The Welding Institute are linked to technology transfer organisations such as the Institute of Materials, Minerals and Mining, known as IOM3. These organisations then offer memberships to industry players at minimal cost and link them to relevant experts when needed.

While Pakistan spends a significant proportion of its tax revenue on defence, the lack of industrial linkages results in almost no spillover to the rest of the economy. Linking defence industrial establishments like the Pakistan Atomic Energy Commission and Heavy Industries Taxila to industry players and research institutions can potentially increase industrial productivity and, in the long run, export competitiveness.

Standardisation, the third factor on our list, has emerged and taken importance of its own. German Institute for Standardization notes that “84pc of the companies surveyed use European and International Standards as part of their export strategy, in other to conform to foreign standards.” The study further notes that exporters also use standards as a marketing tool to enter new markets.

In Pakistan, one key sector which suffers due to poor understanding of standards is IT. Pakistan Software Houses Association’s data shows that IT exports crossed the billion-dollar benchmark in FY18. Nonetheless, this is minuscule compared to India’s exports of $126bn.

Freelancers most often rely on self-learning and go through several iterations before meeting required standards. Awareness campaigns by software houses, workshops by industry experts and short courses through technical and vocational institutes can go a long way to eliminate this bottleneck.

Finally, the most important constraint which Pakistan continues to face despite its geostrategic location is of market access. It is in international trade literature that scale of production is critical for high-tech firms (or industries requiring large initial investments) to compete in the international market.

While Pakistan does have a large population of its own, the consumer base for sophisticated technologies is rather limited. Therefore, if Pakistan cannot guarantee potential investors market access to neighbouring regions such as Central and South Asia, there is no reason to believe that technology-intensive industries will find it worthwhile to establish their foothold in the country.

None of these reforms require significant expenditure. Instead, they require resolve.

Are you examining Pakistan’s political economy? Share your insights with us at prism@dawn.com

Ahmed Jamal Pirzada has a PhD in Economics. He currently teaches at the University of Bristol and is a visiting fellow at the SDPI.

Talha J. Pirzada is a PhD candidate at the University of Oxford. He is also a Chartered Engineer at the Institute of Mechanical Engineers.

Dawn, Pakistan