US-Iran Tensions and its impact on South Korea

For South Korea, the impact of U.S. sanctions on Iran stretches far beyond oil imports.

In recent days, those tensions have escalated. At the end of last week, the United States nearly attacked Iran in response to the Iranian downing of a U.S. drone. The U.S. has subsequently undertaken cyberattacks on Iran and placed sanctions on key individuals in the regime. In response, Iran’s Foreign Ministry warned that the latest U.S. action “means the permanent closure of the doors of diplomacy.”

The current standoff contrasts with South Korean expectations after the Joint Comprehensive Plan of Action (JCPOA) was originally negotiated. At the time, South Korea hoped to benefit from the change in relations and the relaxation in sanctions. As a nation lacking in domestic energy resources and dependent on imports of petroleum and other liquid fuels, Iran could help to meet South Korea’s energy needs. At the same time, South Korean firms would be able to benefit from construction projects in Iran’s energy sector and efforts to modernize Iran’s tanker fleet, as well as to expand trade more generally.

Enjoying this article? Click here to subscribe for full access. Just $5 a month.With the removal of restrictions on Iran’s ability to export oil, Tehran quickly resumed petroleum exports to South Korea and became tied with Iraq as South Korea’s third largest source of petroleum in 2017.

Iran also became an important supplier of the condensates that are used in South Korea’s petrochemical industry. South Korean refineries are designed to handle condensates from Iran and Qatar, which are light in sulfur. With sanctions removed, South Korea had become the largest importer of Iranian condensates, importing as much as 249,000 barrels a day. With access to Iran’s condensates cut off, South Korea’s petrochemical industry will face rising prices and declining competitiveness against competitors in China.

The United States withdraw from the JCPOA and decided to re-impose sanctions on Iran in 2018 as part of its effort to pressure the regime to return to talks over its nuclear program and other activities in the region. As a result, South Korean imports of Iranian oil declined by 60 percent in 2018 and were completely suspended this year with the end of U.S. waivers that allowed for the importation of some Iranian oil.

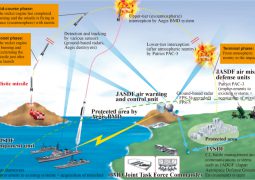

While the current sanctions have forced South Korea to find new sources of petroleum, a conflict between the United States and Iran would present a more difficult challenge. Petroleum, LNG, and other liquid fuels accounted for 58 percent of South Korea’s energy consumption in 2018. Of those fuels, 72.9 percent of South Korea’s crude petroleum imports come from countries inside the Strait of Hormuz, along with 45 percent of its LNG imports. If a conflict were to break out between the United States and Iran that hindered the flow of oil through the Strait of Hormuz it could result in higher prices and energy shortages for South Korea.

The U.S. sanctions regime has had a broader impact on the South Korean firms as well. When the United States withdrew from the Iran deal, South Korea had hoped it would allow “maximum flexibility” in the reimplementation of sanctions so as not to disrupt non-oil trade, but ultimately found Washington unwilling to provide the flexibility needed to maintain construction projects already in the works and normal trade.

When the JCOPA came into effect, Iran needed significant new investments in its energy sector. Its tanker fleet had not been modernized since 2006 as a result of UN sanctions. Hyundai Heavy Industries was the first company to strike a deal to provide Iran with new tankers, securing a $700 million deal to provide 10 new tankers as well as technical support for Iran’s shipyard. Before the sanctions were re-imposed, Iran was also in exploratory talks with South Korean firms for construction of 10 new supertankers.

Hyundai Heavy Industries seems to have been able to complete delivery of the initial four supertankers that Iran had previously ordered as the Islamic Republic of Iran Shipping Lines transferred their ownership to its Chinese business partner, Reach Holding Group of Shanghai. They will now operate in East Asian and Southeast Asian markets. So far, Iran has not been one of their destinations.

The decision to reimpose sanctions on Iran’s oil sector has also hit South Korea’s construction industry. In 2018, South Korea had secured $5.2 billion in construction contracts in Iran, more than any other country. However, the sanctions have meant that Daelim Industrial Co. had to pull out of a $2 billion contract for the Esfahan Refinery Upgrading Project, while Hyundai Engineering and Construction had to pull out of a $521 million project.

U.S. sanctions on Iran also prohibit exchanges in hard currency. To facilitate trade, in the past the United States allowed South Korea and Iran to conduct payment transactions through won-denominated accounts transacted through the Central Bank of Iran and either Woori Bank or the Industrial Bank of Korea.

The Korean government had hoped to convince the United States to provide a waiver for trade in non-oil related products, but those accounts have now been suspended. Without a waiver for financial transactions, some 2,100 South Korean firms are no longer able to export even non-sanctioned items to Iran.

With an inability to import oil or finance trade, bilateral trade between South Korea and Iran has come to a virtual standstill. Because the oil waivers only expired earlier this year, South Korean imports from Iran are only down 31 percent this year after a decline of nearly 50 percent last year. South Korean exports to Iran, however, are down nearly 90 percent through May.

It’s unclear how the standoff between the United States and Iran will end, but for countries such as South Korea the costs extend beyond the importation of Iranian oil. While it might be predictable that construction or manufacturing projects related to the Iran’s oil industry would be lost, the current sanctions regime is inhibiting even non-oil, unsanctioned trade.

- Previous A day of unprecedented violence in Hong Kong as protesters storm the Legislative Council and police fire tear gas

- Next In Kazakhstan’s Tengiz oil field over 30 Arabs wounded in brawl with locals