China’s imports 10 times more of ASML Dutch chip-making equipment in November

- China imported 16 lithography systems from the Netherlands last month for US$762.7 million, a massive year-on-year spike in spending on the critical tools

- Nearly all of China’s spending on imported lithography systems in November came from the Netherlands and Japan, which increased export restrictions this year

China’s imports of critical chip-making lithography systems from the Netherlands surged 1,050 per cent by value in November, in a sign that domestic semiconductor firms are not yet cut off from receiving orders on certain advanced equipment in the wake of tightened US export rules.

China imported 16 of the Dutch projection systems valued at US$762.7 million last month, a tenfold year-on-year increase. That compares with 21 lithography systems imported from the country for US$672.5 million in October. The 46 per cent spread in average price per unit suggests Chinese firms are continuing to get their hands on more advanced systems even as Washington has tried to thwart such efforts.

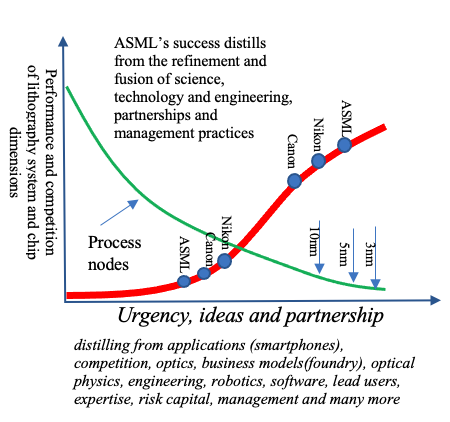

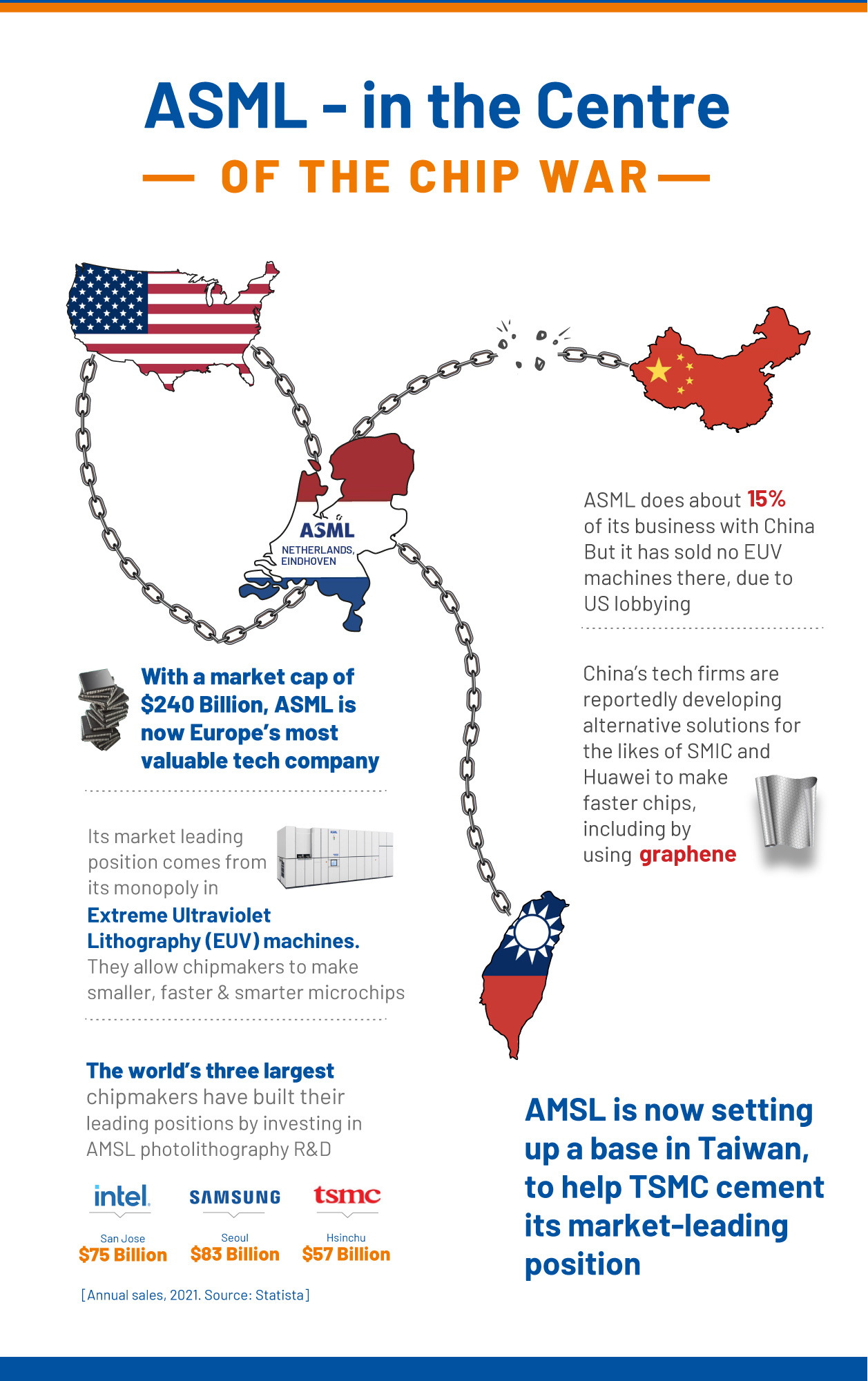

The Netherlands is the biggest exporter of lithography machines, used to make the world’s most advanced chips, almost all of which come from one firm, ASML.

Lithography tools are complex projection systems that are the most important of the 10 categories of equipment needed in the process of making an integrated circuit. China is considered years behind in this tech and has largely failed to narrow the gap with leading firms despite heavy government investment.

Even as Beijing has spent years pushing an agenda of technological self-reliance, less than 5 per cent of lithography systems used in Chinese fabs were made in the country as of 2021, according to data presented by state-backed CanSemi at an industry forum in August

Japan and the Netherlands have rolled out their own export controls on chip-making equipment, affecting sales to China, after both agreed in January to a US request to do so.

In total, China imported 42 lithography systems in November for US$816.8 million. Fifteen of those came from Japan, home to industry heavyweights Canon and Nikon. Together, the Netherlands and Japan accounted for nearly the entire amount China spent on such imports last month.

Lithography tools are complex projection systems that are the most important of the 10 categories of equipment needed in the process of making an integrated circuit. China is considered years behind in this tech and has largely failed to narrow the gap with leading firms despite heavy government investment.

Even as Beijing has spent years pushing an agenda of technological self-reliance, less than 5 per cent of lithography systems used in Chinese fabs were made in the country as of 2021, according to data presented by state-backed CanSemi at an industry forum in August

Japan and the Netherlands have rolled out their own export controls on chip-making equipment, affecting sales to China, after both agreed in January to a US request to do so.

The de minimis rule grants Washington long-arm authority over any product from a non-American company if the product contains at least 25 per cent US-origin technology. However, the latest tweak in the rule essentially made the proportion of such tech irrelevant.

The new rules, effective from last month, restrict Netherlands-based ASML from shipping certain immersion DUV lithography systems, including its Twinscan NXT:1980Di, to a handful of fabs involved in advanced semiconductor manufacturing in China, the company’s third-largest geographic market.

However, ASML CEO Peter Wennink said the latest restrictions exclude the vast majority of its Chinese customers, which dabble in mature or legacy semiconductor manufacturing defined as 28-nanometre and above.

ASML declined to comment for this story.

Analysts have mixed views on how to interpret the increase in imports last month. Some said the spike could be the result of rushed shipments that made it in before the restrictions took effect.

“Most Chinese fabs can still buy DUV [systems] from ASML. Even Semiconductor Manufacturing International Corp [SMIC] can, just not for its Shanghai fabs,” said Dylan Patel, chief analyst at San Francisco-based semiconductor research firm SemiAnalysis.

“You would not see an immediate decline in sales, because the equipment shipped in November 2023 received their licenses, most likely, in late 2022 or early 2023,” said Jan-Peter Kleinhans, director of technology and geopolitics at Stiftung Neue Verantwortung, a Berlin-based technology policy think tank.

Kleinhans said ASML had lead times of around 18 months in the middle of 2023, which means equipment shipped in the fourth quarter 2023 would have been ordered in the second or third quarter of 2022, with ASML applying for export licences sometime later.

- Previous Forecasted debt to reach $312.72 by 2028: Ukraine’s will start repaying its $122 bn. of $157.35 bn. starting 2027, if ….

- Next Chinese ‘golden veil’ to make deadly missiles look like passenger planes