Foreign Companies Face New Clampdown for Getting Money out of China

Until this week, big companies could ‘sweep’ $50 million out of China; now, cap is equivalent of $5 million

SHANGHAI—Multinational companies are suddenly finding themselves in the crosshairs as China dials back its effort to turn the yuan into a global currency, alarmed that it has accelerated the flight of capital from its shores.

In recent days, according to bankers and officials familiar with the situation, China’s foreign-exchange regulator has instructed banks to sharply limit how much companies move out of the country and into their other operations around the world. Until this week, it was possible for big companies to “sweep” $50 million worth of yuan or dollars in or out of China with minimal documentation. Now, these people say, the cap is the equivalent of $5 million, a pittance for the largest corporations.

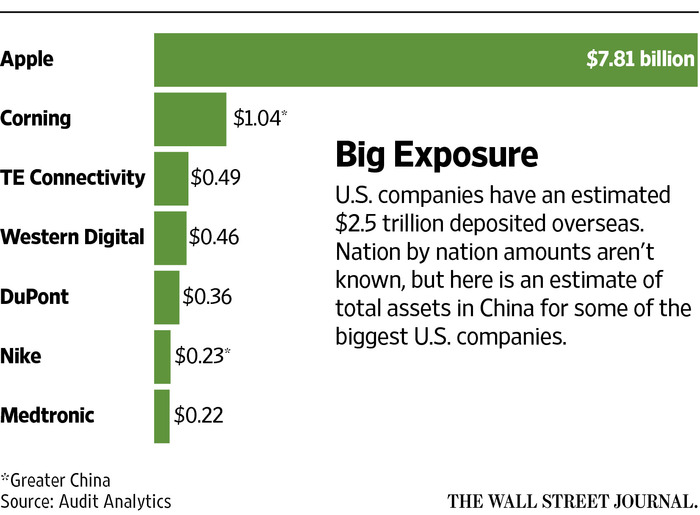

Beijing is fighting an increasingly vicious cycle of capital outflows that weaken the yuan. Most dramatically, the State Council, China’s cabinet, intends to tighten scrutiny of overseas acquisitions by domestic companies, The Wall Street Journal reported last week, which could result in deal delays or outright cancellations. Until now, few of China’s capital-control measures took obvious aim at foreign businesses.

The recent moves effectively erode the yuan’s appeal as a rival to the dollar just two months after the International Monetary Fund added it among its reserve currencies on Oct. 1—an acknowledgment the IMF trusted China to further loosen its grip on the yuan.

Later that month, top financial officers from one of the largest U.S. pharmaceutical makers paid a visit to the Chinese agency that decides how much of its hundreds of millions of dollars deposited in the country can be taken out.

The blunt talk marked a contrast with a year-earlier visit to the same regulators. “Things changed 180 degrees,” said the participant.

The clampdown on “sweeping” follows a meeting on cross-border capital flows last week at China’s central bank, where officials expressed alarm that a rising amount of money is exiting as yuan, rather than dollars, according to notes of the gathering reviewed by the Journal.

Before “sweeping” was permitted in an experimental free-trade zone in Shanghai in mid-2013, companies wanting to move cash generated by their China operations faced cumbersome documentation and extra taxes.

The IMF cited “sweeping” among the reasons it considered the yuan credible as a global reserve asset. The pullback now suggests Chinese authorities are alarmed that so many companies are using it to move yuan directly offshore, such as to Hong Kong, where it can be freely exchanged.

READ MORE

According to notes of its recent meeting, after the central bank determined that the entire net outflow from China during October was in yuan, whereas during the year’s first half amounts were split between yuan and foreign currencies, it decided to instruct commercial banks to all but halt so-called offshoring for the purposes of converting yuan into other currencies.

The meeting notes quote central-bank officials describing the new limits as temporary and their support for the yuan’s internationalization as “unwavering.”

The People’s Bank of China didn’t respond to requests for comment. Yi Gang,the central bank’s deputy governor, told Xinhua News Agency in an interview published Sunday that China’s inflows and outflows are normal and that money will return as China’s economy rebounds. Under the rules for “sweeping,” companies must eventually bring back to China the funds they have taken out as part of their corporate cash pooling strategies, though the time frame is flexible.

Bankers say after last month’s U.S. election, some American businesses began “sweeping” more money out on a bet they might need to move funds quickly if the administration of President-elect Donald Trump declares a tax amnesty on U.S. corporate deposits abroad.

“It’s possible, too, that anticipation of tighter capital controls in the future has nudged the treasury operations of multinational companies to move more money out of China,” said Ker Gibbs, an investment banker who is chairman of the American Chamber of Commerce in Shanghai.

China’s largest domestic companies are also feeling the impact of limits on “sweeping.”

“Up until two months ago, we were able to wire millions of renminbi to an offshore affiliate via this program with no problem,” said an official at a big state-owned electricity company, using another name for the yuan. “But now, our bank has informed us that all such transfers will be reviewed by the foreign-exchange regulator,” the official said.

Chinese authorities blame erosion in the yuan’s value primarily on the dollar’s strengthening, which accelerated after Mr. Trump’s election. After recently touching lows not seen since mid-2008, the yuan is down 6.2% against the dollar so far this year.

The free-trade zone in Shanghai was designed to test financial reforms, though few of the big plans officially announced, such as trading in crude-oil futures, actually launched.

But “sweeping” sparked excitement.

“Trapped cash is no longer a valid concept,” said Lewis Sun, HSBC’s head of cash management, in a promotional video from the bank that explained the program. Other bankers also gushed about the liberalization, as did executives of multinational companies including manufacturers TRW Inc. of Michigan,Dover Corp. of Illinois and Minneapolis-based Pentair Inc.

Asked about the recent moves, the companies declined to comment or didn’t respond.

Now, the need to stabilize capital flows and prevent the yuan from a rapid downward spiral trump ambitions for the yuan’s global use.

Last week, the Chinese premier, Li Keqiang, paid his third visit to Shanghai’s free-trade zone.

Hours after his inspection, the local branch of the country’s central bank held a rare press conference to announce a new risk-control system to monitor currency flows through the zone to ensure they are balanced by supporting inflows—a backhanded indication cash had been leaking out.

—Junya Qian contributed to this article.

Write to James T. Areddy at james.areddy@wsj.com and Lingling Wei at lingling.wei@wsj.com

- Previous Giant Aluminum Stockpile Was Shipped From Mexico to Vietnam

- Next Mongolian government approves fuel tax exemption, road projects