Is new global financial crush coming? US-China trade war….

- The risk of a recession will rise if the trade dispute is prolonged and escalates further, economists and portfolio managers said

- The world’s two largest economies had appeared closer to a trade deal earlier this month

Topic | US-China trade war

Chad Bray

20 May, 2019

Heightened trade tensions between the United States and China have raised the risk of a recession next year if the dispute between the world’s two largest economies is prolonged and escalates further, according to economists and portfolio managers.

Just over two weeks ago, Washington and Beijing seemed poised to reach an agreement to end a trade war that has hurt American businesses that rely on products made in China, increased costs for US companies and consumers, and contributed to an economic slowdown in China.

But the dispute has escalated recently as the US raised tariffs to 25 per cent on nearly US$200 billion of goods from China on May 10 and is preparing to add levies to nearly all Chinese-made products later this year. That has prompted Beijing to retaliate with its own tariffs, effective from June 1.

The whiplash-inducing reversal in tone has unnerved investors and increased fears that an economic downturn is on the horizon more than a decade on from the global financial crisis.

Donald Trump twitter:

For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods. These payments are partially responsible for our great economic results. The 10% will go up to 25% on Friday. 325 Billions Dollars….

“[If] this lasts much longer and nothing happens by the end of June and it drags on to the end of the year, you start to have a bit more concern on growth,” said Esty Dwek, the head of global market strategy at Natixis Investment Managers. “I still wouldn’t see a recession in 2019, but the odds of a 2020 recession or that it comes a bit earlier than expected, then they rise.”

US President Donald Trump and his Chinese counterpart, Xi Jinping, are expected to meet on the sidelines at the G20 summit in Osaka, Japan, at the end of June, but no talks are scheduled between the countries before then.

The US and China have placed tariffs on each other’s goods for nearly 10 months as the Trump administration has pressed Beijing to change years of what it claims are unfair industrial and trade policies.

The two sides called a truce late last year and appeared close to a deal as recently as the last week of April – before President Trump unleashed a series of tweets earlier this month.

Julian Cook, a portfolio specialist in the equity division at T. Rowe Price, said the increased tariffs could be a 20-basis-point drag on US gross domestic product growth in the second and third quarters. It grew at 3.2 per cent in the first quarter.

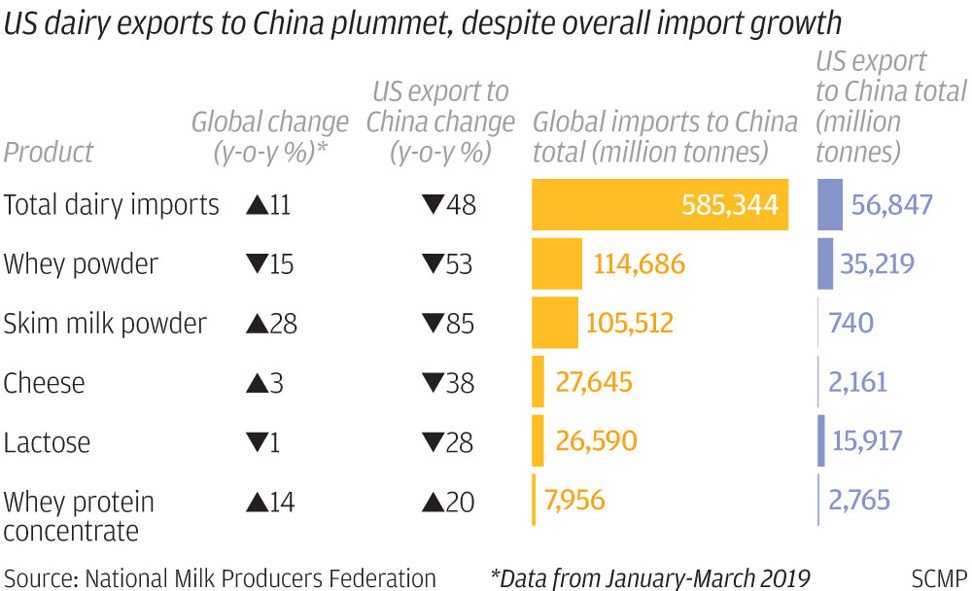

US dairy exports to China have plummeted. SCMP Graphics

“That’s not life threatening from a US perspective,” Cook said. “Does that trigger a recession with the way things stand right now? That is not our central thesis. Sustained and prolonged? Then, potentially.”

S&P Global Ratings said higher tariffs are manageable for both China and the United States in the short term, but the longer-term affect on growth “may be underestimated”.

“The impact on business confidence has been quite significant as reflected in the recent reaction in equity markets,” S&P Global Ratings credit analysts David Tesher and Terry Chan said in a research note last week. “This in turn could dampen investment appetite.”

UBS said it still expects a trade deal this year, but the path “appears to be bumpier” than previously thought.

“A deal in June-July versus one in November-December may mean different things for the short-term market: the latter would expose China and global equities to more social-economic and geopolitical uncertainties,” UBS strategist Wendy Liu said in a research note last week. “However, for long-term investors who are structurally positive on China’s domestic economy, we believe this wobbliness is a window to gradually add to exposure.”

Among its sector preferences in China, UBS is overweight consumer and property stocks and underweight banks and cyclical sectors.

The question of how deeply the trade war will affect investor and business confidence remains an open one.

“To us, the overall macro backdrop is still positive given overall global growth is positive; the effect of the immediate tariffs isn’t significant enough to derail that,” said Shoqat Bunglawala, the head of the global portfolio solutions group for EMEA and Asia-Pacific at Goldman Sachs Asset Management. “Whilst the risk of a protracted negotiation and widening of the tariffs has increased, it’s not yet at the stage that makes us nervous about the economy spilling into a recessionary environment.”

Ivan Colhoun, chief economist for markets at National Australia Bank, said that a prolonged trade war would probably weigh on global growth, which has already been slowing. However, he expects a smaller economic slowdown, rather than a global recession.

“How does that affect the world? If we have permanent tariff barriers between the two countries, the world is slower, prices are higher. Chinese and US consumers lose out because they pay the tariffs,” Colhoun said. “Everyone is worse off to a certain extent because global growth is slower. Countries that stay outside the trade war, they relatively benefit, but everyone sees slower global growth.”

obert Carnell, ING’s chief economist and head of research Asia-Pacific, said that China, in approaching trade negotiations, should not count on the environment changing any time soon, particularly while Trump is in office.

“This is an ongoing process. US and China. US and Europe. US and you name it are going to be talking about trade until we’re no longer talking about President Donald Trump,” Carnell said. “That may not be 18 months. It may be five-and-a-half to 6 years that we’re doing that. Short of a US economic disaster, I think he’s got a good chance of winning.”

- Previous China tells Turkey to support its fight against Uighur militants

- Next ASEAN is a winner in a Trade war: Asia’s winners and losers in US-China clash