New Hoax? Will US billionare S.Lynch by bet o buyng on blown up Nord Streat 2 Gas Pipeline

North Asia

19 views 0

Stephen P. Lynch, who prefers to stay under the radar, says a deal for the Russian pipeline would serve long-term U.S. interests

By Christopher M. Mattews

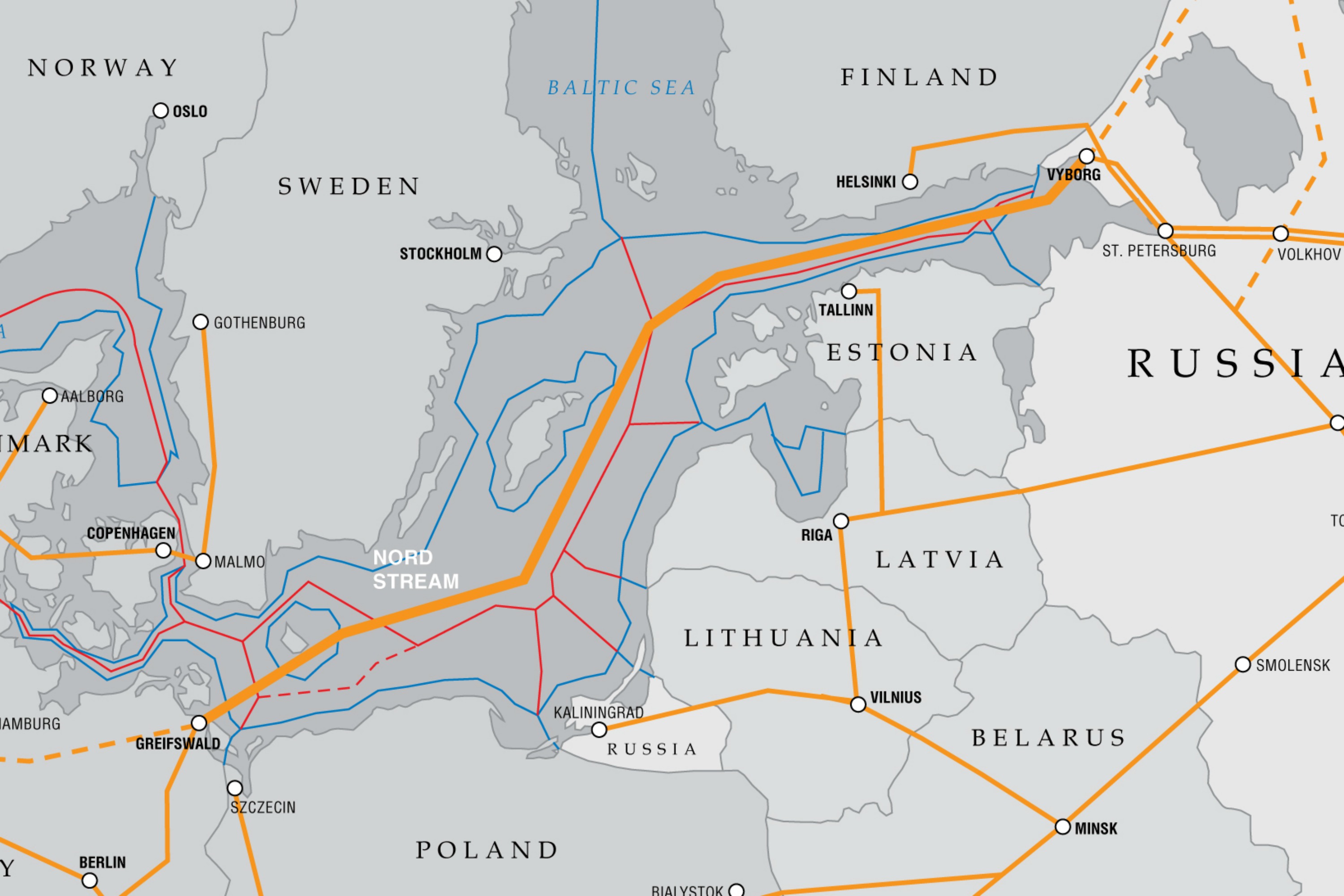

An American investor with a history of dealmaking in Russia has asked the U.S. government to allow him to bid on the sabotaged Nord Stream Pipeline 2 if it comes up for auction in a Swiss bankruptcy proceeding.

Stephen P. Lynch spent two decades doing business in Moscow and now wants to buy the natural-gas pipeline that runs from Russia to Germany. He has argued to U.S. officials and lawmakers that American ownership of the pipeline would provide leverage in any peace negotiations with Russia to end the war in Ukraine and serve U.S. long-term interests.

“The bottom line is this: This is a once-in-a-generation opportunity for American and European control over European energy supply for the rest of the fossil-fuel era,” Lynch said in a rare interview.

Lynch, who lives in Miami and was a large contributor to Donald Trump’s presidential campaign, has told people “he wants to be the richest guy you’ve never heard of,” but his audacious plan would thrust the former Peace Corps volunteer into public view.

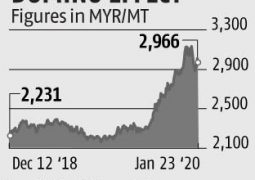

The 765-mile-long pipeline had been a crown jewel of Russia’s petro economy linking its vast gas fields to Europe. It was completed before Russia’s full-scale invasion of Ukraine in 2022 and never became commercially operational. It is owned by a subsidiary of Russia’s state-owned gas giant Gazprom, a unit that filed for bankruptcy in Switzerland days after the invasion. In September 2022, subsea explosions destroyed one of the pipeline’s two trunks. The other remains intact but unused.

The Wall Street Journal previously reported that a team of Ukrainians was behind the sabotage.

Stephen P. Lynch has said U.S. ownership of the pipeline would provide leverage in any Ukraine peace negotiations.

Lynch sought a license from the U.S. Treasury Department in February, according to a letter written by his lawyers at WilmerHale and viewed by The Wall Street Journal. The license would allow him to negotiate for the pipeline with entities currently subject to U.S. sanctions.

The letter said there is a hard deadline in January in the Swiss bankruptcy proceeding for Nord Stream 2 to either restructure its debt—which the letter says is unlikely—or face liquidation. Lynch argues that once the war is over it will be tempting for both Russia and its former customers in Germany and Europe to turn on the pipeline, regardless of who owns it.

Lynch has had success buying Russian assets on the cheap, earning him a reputation as one of the few U.S. investors able to navigate the country’s fraught business and political scenes. He was given a license by the Treasury Department to complete the acquisition of the Swiss subsidiary of Russia’s Sberbank in 2022, after the U.S. sanctioned the parent company.

Questions have been raised about Lynch’s ties to the Russian government.

A civil-fraud suit alleged that Lynch and a group of foreign investors of participated in a rigged auction in 2007 for assets belonging to the former oil giant Yukos, which was broken up by Russia after the company was charged with tax evasion. Managers of Yukos’s Dutch subsidiary alleged that the investors conspired with Russian state officials to predetermine the sale of their company at a fixed price. Lynch and the other investors denied the allegations.

A U.K. judge dismissed the charges against Lynch and the other investors in 2019, writing that the defendants didn’t “indicate any dishonesty” during a 25-day court proceeding.

Lynch has told people that he thinks he can buy Nord Stream 2, which has been valued at around $11 billion, for pennies on the dollar, according to people familiar with matter. He has said many investors won’t bid because of the complex geopolitics tied to the conduit, and the other bidders are likely to include Russian proxies, Chinese entities or others at odds with U.S. interests.

A group of U.S. senators as well as officials at the Treasury and State departments have been briefed or informed about Lynch’s plan, the people said.

An aerial view shows the Nord Stream 2 gas pipeline’s leakage in 2022.

A representative of the Treasury Department didn’t immediately respond to a request for comment. A spokesman for the State Department declined to comment.

Business people and former government officials with experience in Russia said Lynch’s plan faces significant hurdles but could gain momentum if it can be used as a chip to negotiate peace in Ukraine once Trump is in office. The president-elect has promised to end the war quickly.

Lynch gave more than $300,000 to Trump-aligned committees and the Republican National Committee during the most recent election.

Lynch, 57 years old, lived in Moscow for two decades, remaining there after many foreigners left as Russian President Vladimir Putin consolidated power. Lynch, his husband and their children moved to Miami in 2019 because of concern about Moscow’s social environment and the increasing challenges for U.S. citizens to do business as sanctions tightened, a person familiar with the matter said.

After two years with the Peace Corps in Russia, Lynch got his master of business administration degree from the Wharton School in 1998. When Russia fell into a financial crisis that year, Lynch founded Monte Valle Partners to acquire distressed real-estate assets there.

He got one of his first big breaks when he bought a large project next to the Moscow airport from the billionaire Alfred Taubman. He sold most of his stake in that to his Russian business partners in 2007, just as the Yukos liquidation began unfolding.

The billionaire Mikhail Khodorkovsky built Yukos into an oil-and-gas giant following the dissolution of the Soviet Union, but the empire was dissolved after Khodorkovsky fell out with Putin.

The idea to bid on Yukos assets came to Lynch as a “spontaneous combustion idea,” he said in a 2018 deposition taken in connection with the U.K. court case. Many would-be bidders stayed away from the auction, believing only those with political connections could win. Lynch said in the deposition that he believed the bidding would be competitive and fair and that assets could be bought cheaply.

Lynch and his partners ultimately purchased more than $2 billion of Yukos assets at a steep discount, and sold virtually all of it to Deutsche Bank for a profit. The state-owned giant Rosneft eventually swallowed up most of Yukos’s assets.

Some of Lynch’s friends said that he has cultivated relationships with Russian officials, and that it would have been impossible to be a successful and openly gay businessman in Mosow without them. But the friends added they aren’t aware of anything to suggest Lynch has worked to further the interests of Putin or his inner circle.

Lee Wolosky, a former special counsel to President Biden and a friend of Lynch, said Lynch’s proposal to negotiate the purchase of Nord Stream 2 is in the strategic interest of the U.S. and its allies.

“The Biden administration and incoming Trump administration should be able to agree on this,” said Wolosky, who is co-chair of Jenner & Block’s litigation department. “His background as an American investor who has navigated Russia adeptly makes him well-suited to lead the effort.”

Alan Cullison contributed to this article.

Christopher M. Matthews

- Previous Unstable and Unable Kenyanian govement backs down from $2.5 bn contract with Indian Adani Corp.

- Next ‘Fight Till The End’ – Imran Khan’s tells to His Supporters Amid Ongoing Protest