Saudis to boost US ties with $40bn investment

Saudi Arabia is planning to cement ties with US President Donald Trump by investing $40bn in US infrastructure development, according to media reports.

The kingdom’s sovereign wealth fund is set to announce the plans which may be unveiled next week to coincide with Trump’s visit to the kingdom, sources told Bloomberg on Thursday.

Trump will be making his first foreign trip since taking office on 19 May, visiting Saudi Arabia and Jerusalem then heading to Europe.

According to CNBC, Saudi Arabia has been expressing an interest in investing in the US for months.

Saudi Energy Minister Khalid al-Falih told CNBC in March his government believed US infrastructure, in particular, was an attractive investment.

“The infrastructure programme of President Trump and his administration is something that we’re interested in because it broadens our portfolio and it opens a new channel for secure, low-risk yet healthy return investments that we seek,” he said.

Saudi Arabia is also eager to reset relations with the new US administration after bilateral relations deteriorated under former US president Barack Obama, who brokered a historic 2015 nuclear deal with the kingdom’s chief regional rival Iran.

At the same time, Saudi Arabia claimed a “historic turning point” in relations after Trump met Riyadh’s deputy crown prince and minister of defence Mohammed bin Salman in the White House in March.

Following Trump’s meeting with Salman, whose father is the king, the White House issued a statement saying the president supports developing a “US-Saudi programme undertaken by joint US-Saudi working groups” that would invest in energy, industry, infrastructure and technology.

The programme would potentially be worth $200bn in direct and indirect investment in the next four years, the statement added.

Trump has said he intends to push for $1 trillion in US infrastructure investments over the next decade, with $200bn coming from taxpayers and the rest from the private sector.

Saudi Arabia, the world’s top crude exporter, made an aggressive push to diversify its traditionally oil-dependent economy after the drop in global prices since 2014 slashed its revenues.

It has since planned to expand its sovereign wealth fund as part of its attempts to diversify away from oil after prices slumped.

Riyadh this week reported a mix of austerity measures and rising oil prices had helped cut its projected $53bn deficit by two thirds.

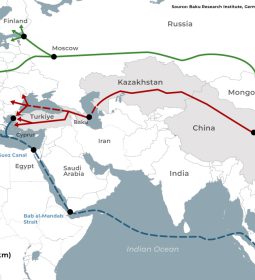

- Previous Uzbekistan and China to further expand bilateral cooperation and work together in building Belt and Road

- Next China, Malaysia exchange 9 MOUs, agreements