The Chearavanonts, Thailand’s richest family, are getting richer helping China

The Chearavanonts, Thailand’s richest family, are getting richer helping China

- Their Charoen Pokphand Group is at the centre of the Eastern Economic Corridor, a project that has drawn the attention of Chinese firms like Huawei and Alibaba

- The Thai government has embraced Xi Jinping’s belt and road plan, promising US$53 billion to develop three coastal provinces

Chia Ek Chor fled his typhoon-ravaged village in southern China and started a new life in Thailand selling vegetable seeds with his brother in 1921. Almost a century later, with the largest family fortune in the country, his descendants are becoming Chinese President Xi Jinping’s key economic allies.

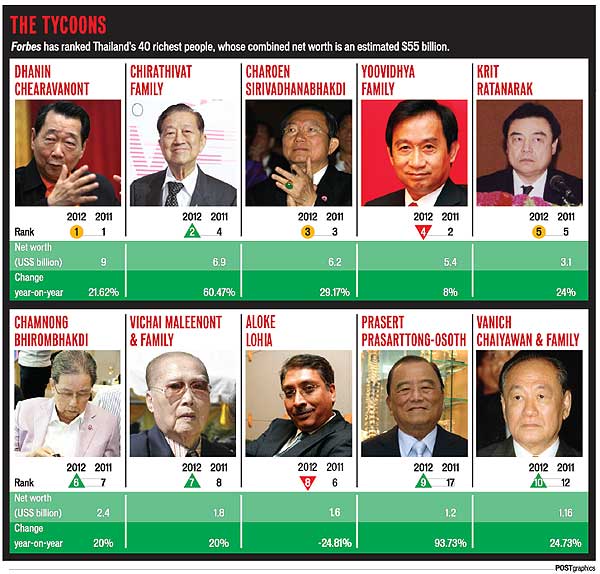

Chia’s son Dhanin Chearavanont is senior chairman of Charoen Pokphand Group, a vast conglomerate that is the world’s biggest producer of animal feed, shrimp as well as a top telecom firm in Thailand. It is at the centre of an ambitious plan to turn Thailand’s eastern seaboard into a tech hub with bullet trains, 5G networks and smart car factories.

The so-called Eastern Economic Corridor is the flagship programme of Thailand’s military regime, a bid to leverage Japanese investment and Chinese tech giants like Alibaba and Huawei to revive an economy that grew 4.1 per cent last year, the slowest rate in emerging Southeast Asia. But a messy March 24 general election means that projects could come under greater scrutiny as critics accuse authorities of dispossessing local farmers to make way for Chinese investors. Alibaba is the owner of the South China Morning Post.

“Locals would be downgraded to second-class citizens,” said Somnuck Jongmeewasin, a lecturer at Silpakorn University’s International College, who studies the EEC. “A colonial era is emerging in the EEC area through Thai-Chinese investment policies.”

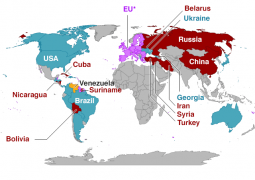

Xi’s signature “Belt and Road Initiative” has come under fire in countries including Sri Lanka and Malaysia for infrastructure projects that were seen as providing little benefit for the host nations, while saddling them with heavy debts. But the military junta that seized power in Thailand in a 2014 coup has embraced the alliance, promising a 1.7 trillion-baht (US$53 billion) investment to develop three coastal provinces close to the capital – Chachoengsao, Chonburi and Rayong.

They are now among the fastest growing regions in the country, with manufacturing eclipsing tourism from resort towns like Pattaya, famous for its sun- and sleaze-seeking crowds. Roads that ran through fields of rice, coconuts and mangoes are packed with cargo trucks and farms are giving way to industry – chemical plants, a Toyota factory. Oil rigs sit offshore of Thailand’s biggest port Laem Chabang. Makeshift stands beneath roadside trees sell palm sugar, sticky coconut rice and sometimes skewers of roasted field mice to the growing numbers of inhabitants.

CP Group is a main conduit for the Chinese investment in the region. A CP-led consortium including China Railway Construction was the lowest bidder for a 225 billion-baht contract to build a 200km (124-mile) rail network linking Bangkok’s two international airports and another near Pattaya with an industrial zone on the eastern coast. The group is also bidding on an airport zone.

But a change of government could lead to greater scrutiny of EEC deals. With no outright majority in the March election, seven parties opposed to the military are trying to form a coalition government. Meanwhile Prime Minister Prayuth Chan-ocha’s military-backed party has explored a coalition with the Democrats, which was headed by royalist former prime minister Abhisit Vejjajiva until he stepped down last month after a poor electoral showing. His father was a CP Foods director for more than 15 years. With no clear majority, it could be weeks or months before a new government is formed.

“The military government will continue to exercise full governmental powers,” said Harrison Cheng, an analyst for Control Risks. “The picture gets a lot more complicated once a new government is in power, regardless of which coalition takes power.”

The opposition has vowed to put up a fight, tired of policies that promote monopolies in the US$455 billion economy, said Bhokin Bhalakula, a former adviser to Yingluck Shinawatra, who was ousted as prime minister about five years ago. Bhokin favours digging a canal across Thailand’s narrow isthmus in the south as an alternative growth model to the EEC. The EEC is linked to the military government’s 20-year national strategy, which is supposed to be binding on future administrations, potentially setting up flashpoints with elected politicians that wish to adopt different priorities.

“They think that bringing giants in will make the economy better, but the little guys at the grass roots aren’t benefiting,” said Bhokin. “It’s just the wealthy who are benefiting.”

While Japanese investors such as Hitachi led early bets on the EEC, CP’s Chinese connections are helping draw technology investment, said Kanit Sangsubhan, secretary general of the EEC Office. China’s investment in Thailand has surged to become the third biggest in approved foreign investment in 2018 after Japan and Singapore.

“The next wave will be focused on high technology, which China is strong in,” Kanit said. He said environmental assessments on land use and a tourism plan aim to minimise the impact on local farmers.

CP’s ties to the EEC range from automotive – it announced a new car plant in 2017 with China’s SAIC Motor Corporation – to real estate, where it teamed up with Guangxi Construction Engineering to develop a 3,068-rai (1,212-acre) industrial estate that targets Chinese investors.

Huawei is investing in Thailand’s first 5G test bed, even as the US urges allies to ban the company from constructing next-generation mobile networks. CP-backed True Corporation is creating an internet of things lab with Huawei and used Huawei equipment to become Thailand’s first 4G provider. A Huawei spokesman said the company was invited to participate in the 5G test bed by the EEC Office.

In a display of how Thailand’s EEC is geared toward drawing China’s new tech giants, Alibaba billionaire Jack Ma met with Prayuth last year and signed a deal for a “smart digital hub” as part of the EEC. Alibaba signed more EEC deals this month, including an expansion of Thai rice and durian exports through Alibaba’s digital platform.

Separately, CP has a partnership with Ma’s Ant Financial, which has a 20 per cent share in the Thai group’s Ascend Corporation, an e-wallet and microloan service. The deal, not part of the EEC, uses CP’s network of 7-Eleven shops.

CP said in a statement that the EEC project “will serve to transform the Thai economy and sustain decades of development and growth”. It said CP’s bid for the high-speed rail contract is part of a global consortium that includes Thai, European, Chinese and Japanese partners.

Dhanin turned down an interview request for this story. At an event in March, CP Chief Executive Officer Suphachai Chearavanont said: “Thailand will become a hub and have connectivity with the whole region, all the way up to China, Vietnam, Myanmar and Malaysia.”

Supachai became CEO in 2017 at the same time as his brother Soopakij became chairman, marking the handing over of the family group to the third generation.

The Chearavanont family fortune is Thailand’s biggest at US$20.9 billion, according to the Bloomberg Billionaires Index, bolstered by CP’s stake in Chinese insurer Ping An Insurance, which has tripled in value since the company acquired the shares in 2012. The Thai clan is one of many with Chinese ethnic backgrounds in Southeast Asia, including the Sys in the Philippines and Robert Kuok in Malaysia, who are leveraging generations-old links with China.

Chearavanont’s rise hasn’t come without controversy. The group in recent years faced allegations along with other companies that its prawn business used a supply chain that relied on slave labour. In 2017, a US court dismissed an injunction to stop CP and others selling prawns unless they were labelled as products of slavery. CP has said it condemns all forms of slavery. In January this year, Thailand ratified the International Labour Organisation’s convention for the fishing industry.

Technology is also being shared. The venture with Guangxi, called CG Corporation, signed a series of agreements including for tech transfer with the Chinese Academy of Sciences. CP Group vice-chairman Tse Ping, a billionaire nephew of Dhanin’s, signed deals in January with the Chinese academy to build “green smart manufacturing” platforms in Beijing and Macau.

The group’s reach shows how far it has come since founder Chia began importing seeds for Thai farmers. In 1946, he and his brother adopted the Thai family name Chearavanont and named the company Charoen Pokphand, meaning “prosperity to consumers” in Thai.

They built the business by literally moving up the food chain – growing crops for feed, processing packaged foods and owning supermarkets, according to William Kirby, a Harvard Business School professor who has studied the company. It was among the first Thai investors in Shenzhen in the economic opening under Deng Xiaopeng, and has continued to spread its business interests.

“This is now a widely diversified group,” said Kirby. “In Thailand first, with stakes in agriculture, telecom, 7-Elevens and many other things. Then in China.”

- Previous Uzbek City of Samarkand to Host Pilaf Festival to Promote International Tourism

- Next Osh celebrates becoming Culture Capital of Turkic World