Lira drops after Ankara takes delivery of Russian missile system

The lira fell against the dollar on fears that the United States could soon impose retaliatory sanctions against Turkey.

![Lira drops after Ankara takes delivery of Russian missile system Turkey's official currency, the lira, lost some of its value against the US dollar on Friday after the country received parts of a Russian missile system that the US opposes [Lefteris Pitarakis/The Associated Press]](https://www.aljazeera.com/mritems/imagecache/mbdxxlarge/mritems/Images/2019/7/12/71302a23752d45e690da9fb3c6c32300_18.jpg)

The Turkish lira was 1.3 percent weaker against the dollar on Friday over United States sanction worries, after Russia delivered S-400 air defence missile system parts to Turkey.

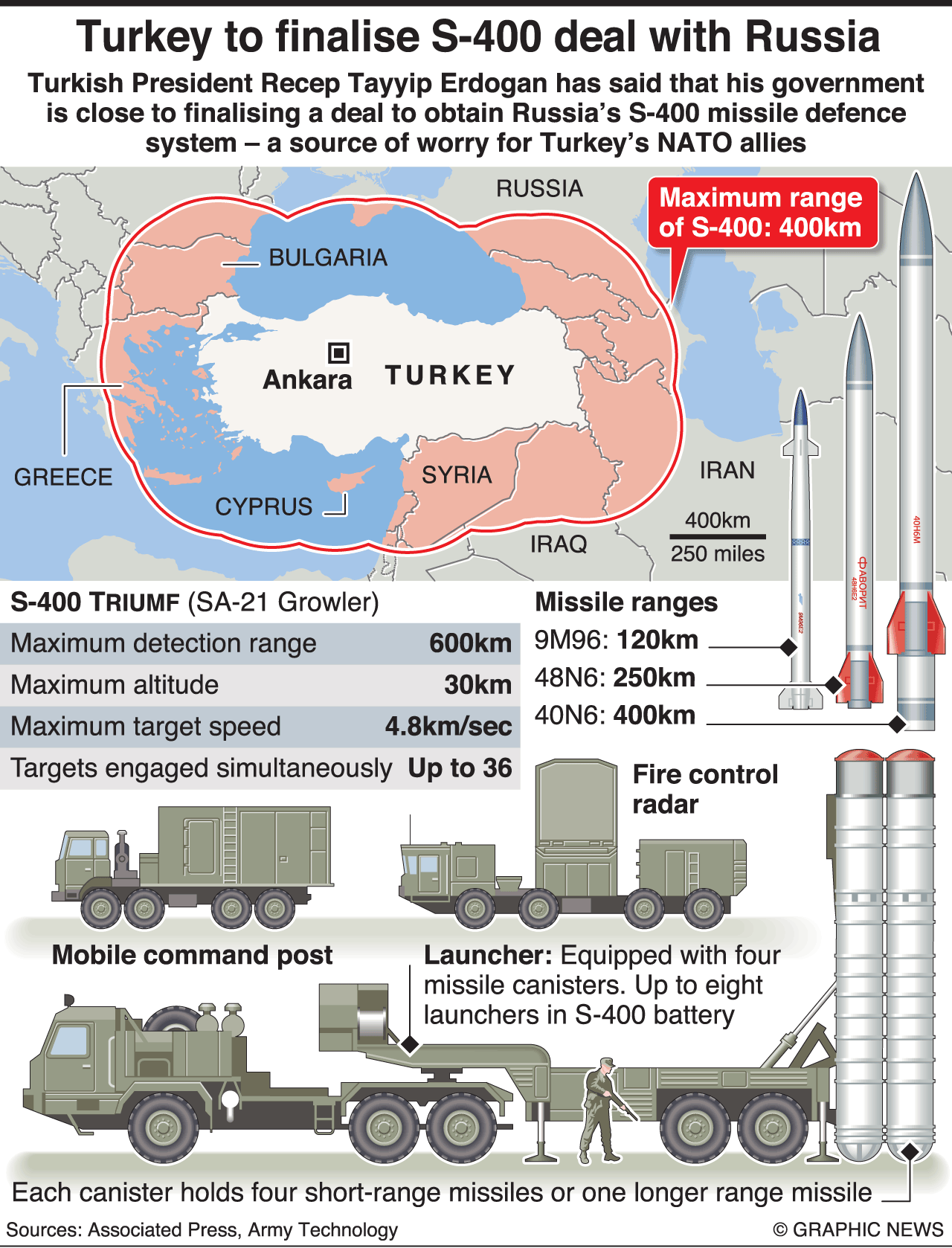

The first parts of the S-400 air defence system were flown to a military airbase near the capital, Ankara – a move expected to trigger US sanctions against the North Atlantic Treaty Organization (NATO) ally and drive a wedge into the heart of the Western military alliance.

At 1450 GMT, the lira stood at 5.76 against the US currency, having weakened as far as 5.7780 earlier.

Cristian Maggio, head of emerging markets strategy at TD Securities, said markets had barely begun to react to the S-400 delivery and that US sanctions risks should not be underestimated.

“They will have consequences for geopolitics and a non-negligible risk for the Turkish economy, which is already in bad shape,” Maggio said.

The US says the Russian military hardware is not compatible with NATO systems and that the acquisition may lead to Ankara’s expulsion from an F-35 fighter jet programme, in which Turkey is a manufacturing partner.

Fears over a fresh bout of sanctions also saw Turkey’s dollar-denominated sovereign bonds tumble sharply and the price of insuring exposure to government debt spike.

Longer-dated maturities took the biggest hit, with 2038 and 2040 bonds losing around two cents, according to Tradeweb data.

The main BIST 100 index fell 2.35 percent while the banking index was down more than 3.3 percent at 1450 GMT.

- Previous Hong Kong protesters take aim at Chinese traders

- Next West lies, locals say as waste piles higher in Jakarta’s vast landfill